How To Track Small Business Travel Expenses

Right now, many of us have been left asking ourselves whether business travel will ever be the same. There's one thing we can all be certain of though - it will eventually start up again.

Our advice for the time being is to safeguard your operations and prepare for the future. Consider this: Do you know how to estimate the amount of small amount travel transactions your company is making?

With minor expenses made during business trips being, by volume, the most numerous, have you ever noticed how they're often the most difficult for you or your company to track?

That's where Corporate Cards can help. Especially now, when saving time and money are at the top of any company’s priority list.

In this article, you'll discover how you can better equip yourself and manage those small business travel expenses ahead of the ramp up.

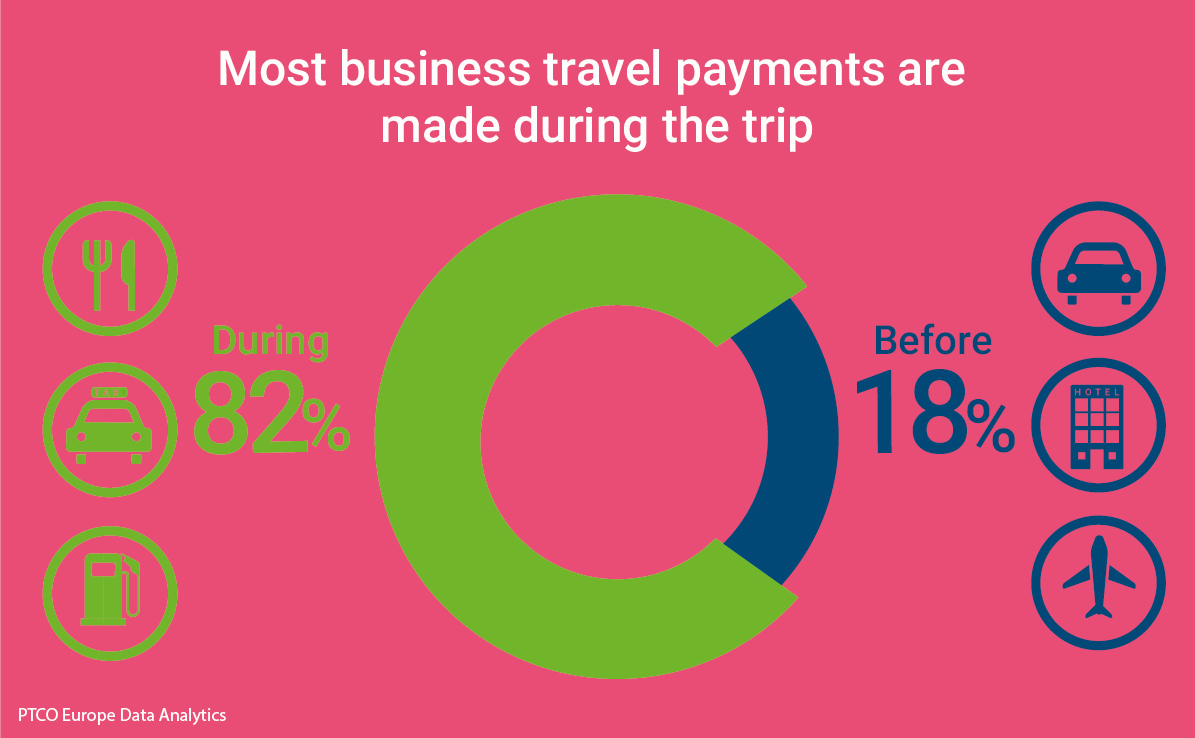

More than 80% of financial transactions related to business travel are made during the business trip.

(PTCO Europe Data Analytics).

Outside of transactions made for air travel (7%), hotels (8%), and car rentals (3%), 82% of purchases go toward small expenses such as catering, taxi fares and fuel.

Beyond their volume, these small expenses are particularly difficult to trace for the company as they come from a diverse range of sources and merchants. Such transactions make expense management much more difficult for travel managers.

Rather tellingly, the catering sector, which accounts for 30% of a company’s expenditure per year, is made up of more than 10 million establishments, according to the Paytech Financial Institute.

How does this stack up to the rest? Well, air expenses are incurred by “only” about 5,000 companies, whereas hotel expenses can be incurred by up to 500,000 establishments.

But fear not — it is still possible to identify and track these scattered expenses, as long as your company provides its business travelers with a suitable payment solution: Corporate Cards.

The Card Acceptance Network: A Major Challenge

One of the biggest challenges faced by companies is choosing a card provider that offers a wide acceptance network for all merchants. This is what will enable employees on the move to pay for their business expenses anywhere and from any destination.

While business card providers are generally good at providing coverage in city centers and urban areas, this is not always the case in rural or remote areas.

That's why it's necessary to give preference to payment providers that offer a wide network for accepting their payment cards, including in remote geographical areas and distant countries.

The number of outlets in the Mastercard network, for example, is more than three times greater than the American Express acceptance network.

The wider the acceptance network, the more points of sale the business traveler will have access to and the less likely it will be that merchants refuse to accept payments, if ever.

This makes life much easier for the traveler, helping them feel more comfortable as they travel, especially when it comes to the payment of business expenses. This comfort and satisfaction can then be increased further if the payment card is equipped with "contactless" technology.

Between 2017 and 2018, contactless payments increased by 156% in France and 97% in Europe (source: Mastercard).

Although contactless payment is capped at €30, it unquestionably speeds up and simplifies the transaction process, to the satisfaction of business travelers. It's a technology that they appreciate all the more when you consider that 60% of transactions related to their business trips involve amounts less than or equal to €30.

The Corporate Card: The Advantage of Visibility

On the other hand, as more business travelers pay for their expenses with their corporate card, the company will gain more visibility into the expenses incurred.

It's quite simple: Without the use of this means of payment, more than 80% of transactions involving small amounts are not captured by companies and therefore remain invisible.

With corporate cards, the company is able to better trace, control and manage them.

Visibility will also be optimized if the company combines the use of the corporate card with other payment solutions such as the embedded card or the virtual card.

The latter, for example, is best used when paying for reservations such as air and rail tickets, car rentals, travel agencies, etc., where the amounts are generally higher.

All the payment data can then be centralized in a reporting tool that provides the company with precise and customizable analyses of each type of expenditure incurred, both by employee or service provider.

To dive even further into this process of traceability in travel expenses, it's also in the company's best interest to choose a single payment service provider and centralize all its payment solutions within a single contract.

By equipping itself this way, the company will have 360° vision, allowing for a consolidated approach to the travel expenses of all its subsidiaries. This provides it with a powerful tool when it comes to negotiating its pricing conditions with suppliers.