Payment by corporate card: 5 mistakes to avoid

Using corporate cards has many advantages over other corporate payment methods.

However, few companies take full advantage! Misusing corporate cards can rob you of several significant benefits...

Here are the five mistakes to avoid when choosing to pay your professional expenses with a corporate card:

1: Choosing individual rather than the company responsibility

When setting up your corporate card program, you need to choose which accounts the cards will be assigned to.

In other words, you choose who will be responsible for the transactions made with the cards:

- If the employee's account is debited, the responsibility is individual.

- If the company's account is debited, the transactions are the responsibility of the company.

The advantages:

- Benefit from immediate visibility on company expenses and cash flow

- Benefit from better control of transaction data and remove barriers to privacy of personal bank account data

- Relieve employees of a sometimes difficult to manage cash advance by assuming responsibility for business expenses associated with the travel that the company requires of its employees

- Facilitate the implementation of corporate cards by removing the barrier of employee solvency - no need to have a sufficient credit profile to benefit from a corporate card if the company bears the responsibility for the transactions

- Reduce the number of expense reports to be issued and processed, with significant savings in the process

In fact, when there is no advance of travel expenses on the part of an employee, there is no reimbursement to be made: the traveler does not waste time issuing an expense claim and managers save money with an eliminated or reduced expense claim processing procedure.

Given these advantages, it is legitimate to ask why French companies still prefer individual responsibility.

This is mainly due to the belief that the choice of corporate responsibility is less secure than that of employee responsibility. Companies fear the abusive and fraudulent use of payment cards, for which they do not want to be held responsible.

However, it has been shown that this risk is extremely low: around €72 of damage for every €1 million spent (Paytech 2018 study).

Moreover, insurance in case of fraudulent use or "misuse" of corporate cards largely limits a company's liability since it allows the company to recover the amount of all damages caused.

2: Overemphasizing the extension of payment periods

This may seem counter intuitive at first.

Yet it is often true.

Moderate deferred debit cards are preferable to extra long deferred debit cards.

There are five very simple reasons for this:

Delays in payment do not create or solve cash flow problems: they only postpone them.

By getting the maximum extension of your payment terms, you hide or postpone cash flow problems - but you don't get to the source of the problem.

In other words: delays mask the symptoms but do not treat the cause.

To improve cash flow or working capital, it's better to focus your energy on analyzing expenses and improving your cost policies than on negotiating extra long deferred payment terms.

Requiring very long lead times sends the wrong signal to card providers.

As a consequence of the above reason, credit card providers and financial partners have every reason to be concerned when a company concentrates its efforts on achieving particularly long payment terms.

Is the company currently having difficulties managing its cash flow? Or does it simply believe that extended payment terms are crucial to its financial health?

Either way, the signal sent does not inspire confidence.

Moderate deferred debit is in the interest of employees

In the case of a corporate card with individual liability, the employee's bank account is debited.

Do employers who incur expenses during business trips prefer:

- to benefit from an extra long delay before being debited?

- or to be debited the following month, with quick reimbursements following each expense advance?

It is best to ask the employees concerned for their opinion, but it is likely that the second option will give them greater visibility and better management of their expenses and cash flow.

Moderate debit is in the suppliers' interest

With a corporate card, no matter how long it takes for your company, suppliers are guaranteed to be paid quickly.

If your deferred debit is extra long, it means that your provider will take care of advancing the charges to the suppliers.

This is not without cost for your company: if you extend the debit period, your provider will charge you for it in some way, often in the form of interest.

Reviewing your requirements in terms of payment deadlines enables you to activate more important negotiation levers

Today, even if it means negotiating with its partners, it is better to give priority to better access to data rather than overly long payment terms.

By devoting less effort to extending payment terms, you can focus on requests that will have a greater impact on your business.

3: Paying more attention to year-end discounts than to the "value per transaction" indicator

This error complements the previous one: sometimes we put too much effort into the wrong fights, such as the extension of payment deadlines... or year-end discounts.

Today, the indicator that should catch the attention of companies with corporate cards should be the value per transaction.

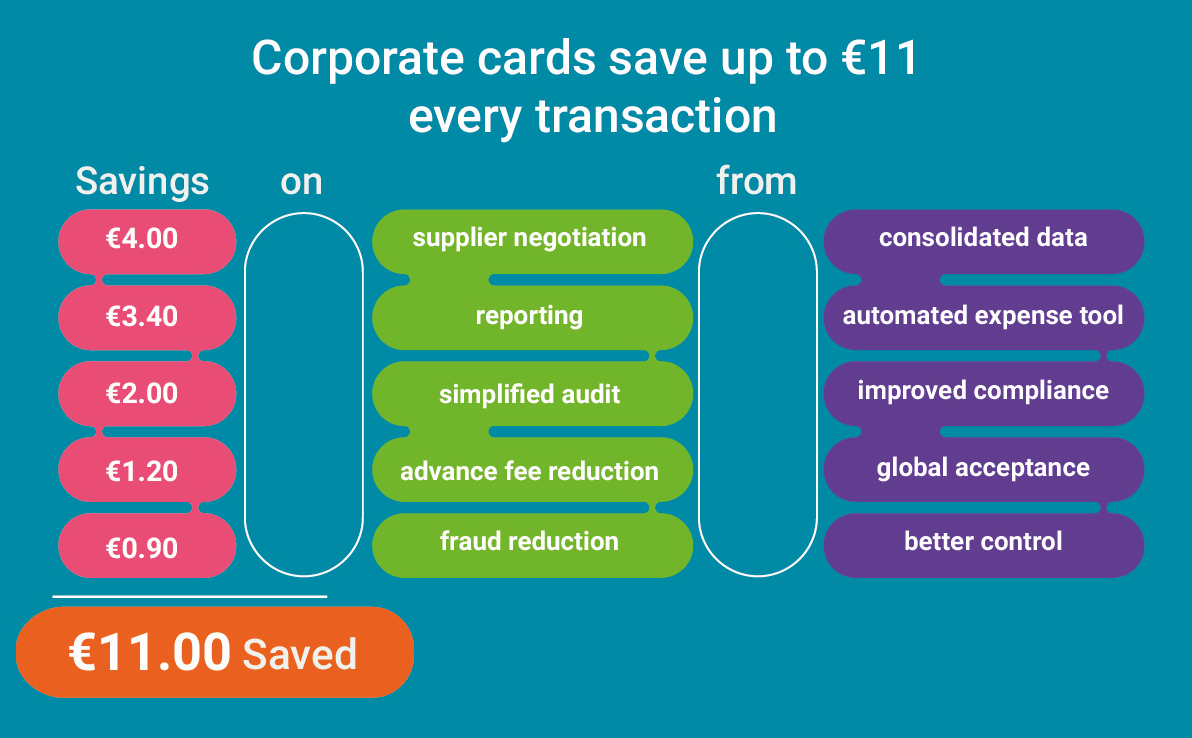

You can save money on each transaction by optimizing different steps in the commitment and processing of an expense. Discounts from card providers are only a small part of the potential savings!

Here are the various savings you can make with the corporate card, even without year-end discounts:

- Savings by improving negotiations with your suppliers, thanks to the consolidated payment data offered by the corporate card

- Savings realized by automating the processing of expense claims

- Savings by simplifying your financial audit and improving compliance

- Savings achieved by reducing advance payments (and thus the management of administrative costs and the resulting risk of fraud)

- Savings achieved by reducing the number and amount of frauds

In total, corporate cards save up to €11 per transaction (PayTech Commercial Client Database 2009-2015 study).

4: Not taking advantage of all available settings for the corporate card

The procedure for setting up corporate cards can be impressive. It's a transformation process that takes time and organization.

We often make the mistake of believing that once the corporate cards are delivered and interfaced with ERPs, the job is done.

This is a mistake!

Continuous attention must be paid to the configuration of the corporate cards in order to take full advantage of their benefits.

For example, don't forget to adjust transaction rules such as ceilings, authorized suppliers, etc.

Then, afterwards, monitor spending and improve these rules as you learn.

This will allow you to effortlessly enforce your Corporate Travel Policy (CTP).

It is also a further step in improving your control procedures, as well as a relief for your employees who will be able to incur expenses without fear of being denied reimbursement during their business trips.

5: Forgetting to mix different payment solutions

Obviously, the corporate card is extremely practical for paying for many mobility expenses, and in particular all the on-the-go expenses incurred by business travelers while on their actual trips:

-restaurant expenses

-taxi fares

-gasoline costs

-parking

-and more

However, it is not an optimal means of payment for all uses. It would be a mistake to rely only on the corporate card for the entirety of your professional expenses!

This is why we do not advise companies to choose just one payment method, but on the contrary to create a mix of payment solutions and to use several types of corporate cards.

In this way, you have the best payment solution for each use and your mobility expenses are covered throughout your travels".

For example:

- Reservations made prior to the trip, including air and rail tickets, which can be paid for with a card that is lodged

- Expenses on the spot or during the journey are preferably made directly by the employee on the move, using his or her corporate card

- Expenses incurred by occasional travelers can be paid for with single-use virtual cards

- Please note that event expenses (MICE), training, etc. can also be paid for with a card slot and/or virtual cards