The virtual answer to the B2B payment question

The pandemic is digitalising procurement. So digitalise your payment process too.

How? Read on to find out

A recent AirPlus survey identifies four key priorities for B2B purchasers:

- Automation

- Control

- Cost reduction

- Cash flow

One payment solution ticks all four boxes: virtual cards. This payment solution is the key to future-proofing your procurement for the pandemic recovery and beyond.

Corporate digitalisation accelerates to warp speed

Closed offices, disrupted supply chains, a travel shutdown – in the business world, almost nothing remains untouched by the coronavirus pandemic.

Arguably the biggest change is digitalisation. Adoption of virtual technologies and services was already intensifying before the pandemic hit. Now it’s accelerated to warp speed.

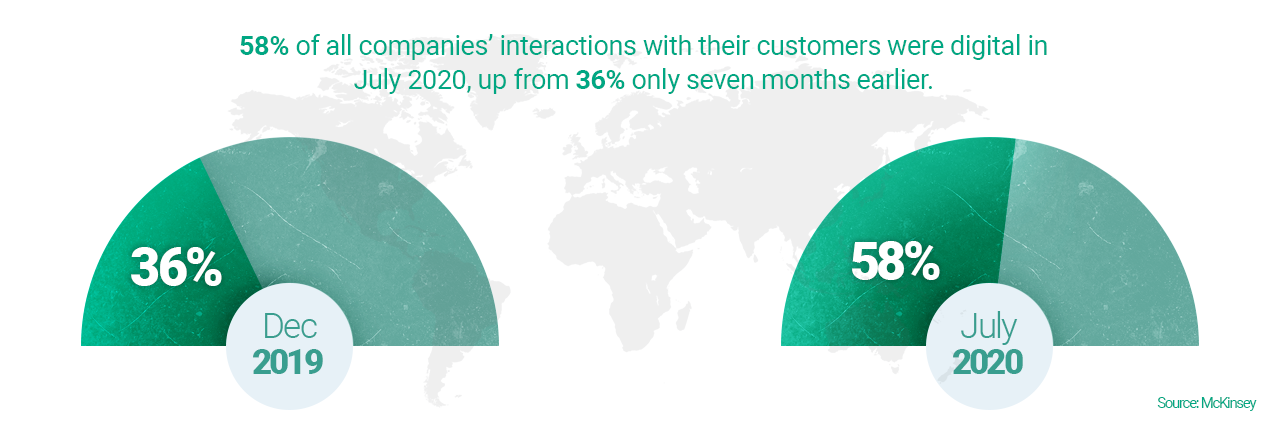

A global survey of executives by consulting giant McKinsey found 58% of all companies’ interactions with their customers were digital in July 2020, up from 36% only seven months earlier.

The change is easy to understand. When customers, assets, and people can no longer all be in one place, they have to connect virtually. To quote advisory firm BDO, it’s “go digital or go dark.”

Digitalisation and purchasing

The pandemic and digitalisation are transforming front-of-house engagement with customers. But is the same true for how companies operate internally? AirPlus is a specialist B2B payment provider, so we surveyed 238 corporate professionals to learn their most important purchasing priorities since the pandemic.*

Here were our respondents’ top four choices:

- Automated processes

- Better control and monitoring

- Cost reduction

- Better working capital

Spend better – not less

These results taught us a very important lesson. Companies understand that process efficiency ultimately means financial efficiency too. These may be tough times but businesses don’t necessarily want to spend less: they want to spend better. Maximising automation and control can go a long way to creating savings without reducing spend.

Pay efficiently to grow sustainably

Increasing procurement process efficiency depends on the right payment method. That’s where virtual cards like AirPlus Virtual Cards Procurement come in. They’re accepted anywhere Mastercard is – at 37 million merchant locations in more than 210 countries and territories.

Create a card when you need to pay: a hyper-efficient, data-rich process that can even be set up for recurrent transactions.

Buying digital services

It’s not just how your company buys that is evolving. It’s what you buy too.

Think of what your company has bought more of in the pandemic, such as IT services. Online meeting providers like Zoom and Microsoft Teams are high on most of our lists. (More on what employees need to work from home here)

Another example is the rapid rise of online training, which has boomed as companies keep employees connected and motivated through professional e-learning while they cannot be together face to face. Virtual coaching has become more important to re-skill employees for work in the new digital environment – and the tools for digital learning have improved too

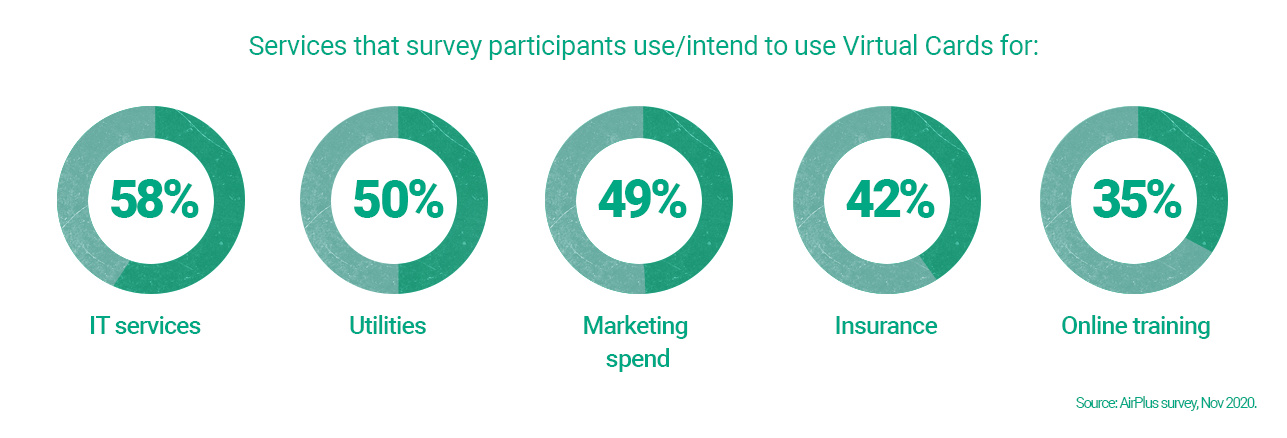

As companies increasingly consume services digitally, it makes sense to buy and pay for them digitally too. And based on our findings, companies are grasping that quickly. In our survey, we asked participants to list services they use virtual payments for, or intend to do so. All categories performed well, suggesting businesses already value virtual cards as a comprehensive payment solution across B2B purchasing:

Many of these categories, like IT cloud services or electricity and other utility payments, are usually recurrent purchases, which can be set up just once on a virtual card. The more you can automate payments, the more efficient.

We reported in a previous article how marketing spend is also migrating to digital platforms, allowing for precise tracking of return on investment. When paid with a virtual card, the card number’s uniqueness offers the same per transaction granularity of information as the advertising it pays for. What does that mean for you? More data, more control, more savings.

It’s a similar story for insurance, perhaps the sector that has digitalised the fastest during the pandemic. Virtual cards are the perfect FinTech payment complement to InsurTech. B2B customers pay efficiently for their insurance needs with virtual cards. Meanwhile insurance underwriters, online brokers, and platforms are using virtual cards to pay their own suppliers like other insurance providers or services like medical assistance and policy payouts, gaining in payment terms and optimising their working capital.

Your next steps to taking B2B payments virtual

Our survey shows some of the evolution and challenges B2B purchasing is facing. It also shows companies are understanding how virtual cards aid this transformation.

But how can you get there? Take these 5 simple steps in your switch to Virtual Cards Procurement:

- Review all the indirect products and services used by your company and whether you have switched to digital purchasing for them.

- Review the payment methods you use today. What are they, and do they optimize your process, control, data, and working capital?

- Understand what you want your payment solution to achieve for you and how virtual cards will enhance your B2B purchasing digitalisation process.

- Identify the data you need in the procure-to-pay process (cost center, department, merchant details) and which payment method will help best with that.

- Talk to us about AirPlus Virtual Cards Procurement. We are a virtual payment pioneer with deep experience in rolling out the controlled, data-rich payment solution that completes your digitalisation journey. Request a meeting here.

* A total of 238 professionals from different corporations in France, Germany, Switzerland, Italy, Belgium, the Netherlands and Nordics participated in our survey in November 2020.