What is long-tail spend management and why does it matter?

Spend management is vital for businesses. The ability to oversee spending, manage cash flow, and ultimately maximize the value of each purchase can lead to significant savings in both time and cost.

But, with the sheer amount and diversity of transactions taking place – the long-tail spend – this can be a challenge. And if not managed effectively, you could find your business playing catch-up.

So, what exactly is long-tail spend, why is it so important for businesses to manage, and what solutions are there to better do so?

The importance of spend management

To understand the concept of tail-spend, you’ll first need to be familiar with the role of spend management.

Spend management refers to the processes, strategies, and technologies that organizations use to control and optimize their corporate expenditures like procurement and supply chain management.

It differs from other roles like expense management, which focuses more on the systems for processing, paying, and auditing employee-initiated expenses.

Instead, the goal of spend management is broader: To efficiently and strategically manage all aspects of spending to achieve cost savings, improve operational efficiency, and enhance overall financial performance.

To do so, it’s necessary to understand where spend is going – which is done by first categorizing each and every transaction into strategic and non-strategic spend.

Understanding tail-spend

For most businesses, 80% of spend goes towards 20% of suppliers. That’s the Pareto Principle, for those who know.

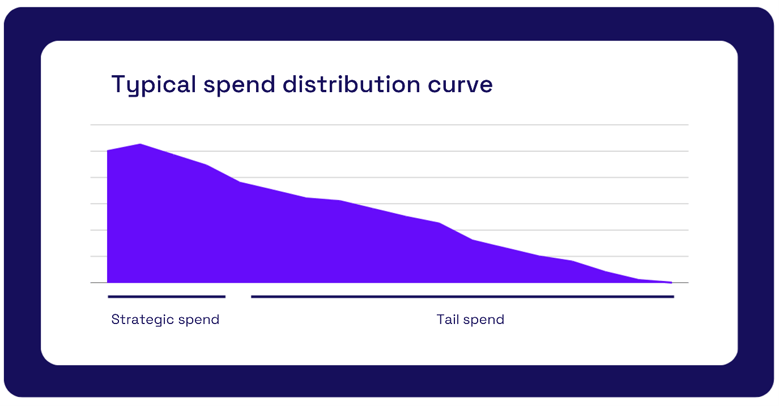

However, the inverse is also true: 20% of spend goes towards 80% of suppliers. We can best see this using a spend distribution curve:

As you can imagine, tail spend refers to the tail end of the distribution curve – the lower 80% of transactions. Essentially anything that is not classed as strategic can be categorized as tail spend.

That’s not to say it’s not important though. Businesses need to work with all kinds of suppliers for their day-to-day operations. Global brands have been known to work with tens of thousands or more. And many simply don’t know the true number of suppliers they work with. [1]

Naturally, some suppliers are utilized more than others. And it’s at this scale that the benefits of proper management over long-tail spend become clearer.

Now that we understand what tail spend is and its role in spend management, let’s take some time to break it down and define long-tail and tail-end spending.

What is long-tail spend?

Long-tail spend, also known as indirect, or non-strategic spend, relates to a business's spending pattern, specifically to the large number of suppliers with low spend. It arguably offers some of the biggest cost savings when it comes to procurement.

Compared to tail spend, it’s more focused towards the lower end of the curve – the area that presents both the most problems and the biggest opportunities. To put it simply: All long-tail spend is tail spend, but not all tail spend is necessarily long-tail spend.

This is in contrast to direct or strategic spend, where a small number of suppliers account for a significant portion of the spend. As the name suggests, these transactions are generally more strategic – often related more to the core business.

Examples of long-tail spend

The best way to understand long-tail spending is to see what sort of transactions would be classed as such. Here are a few examples:

- Low-value purchases: This can include small and routine purchases like office supplies, stationery, or minor equipment, that individually have a low monetary value or small volume.

- Miscellaneous expenses: Things that fall outside the main procurement categories, including items not covered by existing contracts or agreements.

- Freelancers or temporary labor: Especially for short-term projects that may not be part of long-term strategic workforce planning.

- Subscription services: An increasingly common category that covers various subscription services that are not centrally managed – think software subscriptions, online tools, or other recurring expenses.

What is tail-end spend?

Tail-end spend focuses on the smallest percentage of transactions or suppliers that make up the tail end of the spending distribution curve – the tail of the tail. These are the one-time suppliers/vendors businesses often use for odds and ends.

Mixed into this is the maverick spend, where goods or services are purchased outside the scope of the defined spending policy.

Long-tail spend – especially the tail-end and maverick spending aspects – is the more pressing issue for businesses. Each supplier needs to be onboarded into their procurement systems, with all the necessary data to meet the requirements of regulations.

Despite the challenges, effective management of this spending can lead to cost reductions and operational benefits. But, due to its complexity, businesses often overlook the importance of managing long-tail spend.

The complexity of long-tail spend

By its very nature, long-tail spend is complex to manage.

No two transactions are the same – buying minor office supplies is substantially different from, say, purchasing materials for R&D, for example.

Then there’s the volume of expenses: Some are small, frequent costs, while others are large one-off purchases. And it can include anything from employee expenses and subscriptions to memberships and research investments.

This isn’t helped by the fact that traditional procurement processes are not optimal for managing long-tail spend. The modern purchasing landscape is becoming increasingly dominated by online platforms, which has introduced a wider variety of suppliers. Traditional platforms are inefficient in handling this.

Altogether, this makes costs unpredictable and administration complicated.

And that’s not to mention other important considerations: Regulatory compliance, balancing cost-cutting and investment, and adapting to technological advancements.

It’s clear then that long-tail spend requires careful management to prevent financial impact, and so businesses need to align these costs with their operational goals and strategies.

But businesses are lacking a suitable payment solution to fit the needs of these often-one-off purchases. Paper checks are still widely used for such use cases, with “billions of checks being written on single-use transactions or non-recurring payments”. [2]

Thankfully, there are more modern solutions out there to help with that.

The role of virtual cards in long-tail spend management

With meticulous planning, strategic resource allocation, foresight, and adaptability, efficient expense management can lead to increased profitability and business growth. But legacy solutions can make planning particularly time consuming, keeping employees from their important daily tasks.

Thankfully, modern solutions like virtual cards and automated compliance checks offer scalability, adaptability, and control over procurement and payment processes, helping you streamline long-tail spend and reduce risk.

Why virtual cards?

Virtual cards offer a secure, convenient, and digital solution to payments. Their introduction marks a significant shift in payment technology, consumer-like experience to B2B purchases, in a few ways:

- They provide swift and seamless transactions that can be easily revoked, offering enhanced security. This makes them especially good for online transactions – which typically make up a significant portion of long-tail spending.

- An unlimited number of virtual cards can be issued, each with their own details. This makes them easy to track and manage.

- When a virtual card is generated, they are locked down to one merchant and have a set budget. This enhances control and helps reduce maverick spending.

Virtual cards provide you with the control and security needed to manage this indirect spending, even to a greater extent than physical cards. You can improve compliance, increase efficiencies in the payment process, and even improve the relationship with your suppliers.

It’s no wonder that firms using digital to manage tail spend can expect an average of 5% to 10% reduction in their annual expenditures. [3]

So that’s the payment handled – what about the other pains?

The power of automation in procurement

As mentioned, one of the biggest headaches of long-tail spend management is the scale of transactions and suppliers taking place. If not handled right, this can lead to tedious paperwork down the road.

Automation is the clear answer to this problem. It plays a crucial role in streamlining and optimizing procurement processes, especially when it comes to managing long-tail spend:

Process efficiency

The most obvious benefit is increased efficiency. Less time is spent doing manual work and transferring or inputting data between platforms.

Compliance

For compliance, approvals become easier too. Automated approval processes follow pre-defined business rules to enable faster workflows – nothing gets bogged down by a weak link.

Data analytics

Integrations also allow for automated, real-time data collection. This leads to improved insight into your company’s spending patterns, supplier performance, and compliance.

While virtual cards are a great asset for tackling the payment-related issues of long-tail spend, it’s when they’re paired with automation that you’ll be able to significantly streamline long-tail spend management and enable a truly end-to-end purchasing process.

Combining virtual cards with end-to-end purchasing processes

End-to-end purchasing processes offer the convenience and scalability needed by enterprise businesses.

Having a predefined procedure for the many different workflows that go into purchases are what ensure long-tail spend doesn’t end up as maverick spend, for example.

Thankfully, technology is making this easier.

The use of automation and virtual cards enable the development of end-to-end purchase processes: pre-approvals, approval flows, customizable dynamic request forms, automated compliance processes, and complete transparency.

That last point is particularly important: The ability to oversee the entire purchase from request to payment provides data and insight into where spend is going. This can in turn be used to better allocate budgets and even negotiate with suppliers.

This is exactly what spend management needs to fully understand: the extent of long-tail spending and bring maverick spending to a minimum.

Remember the goals of spend management? Between the use of virtual cards, automation, and an end-to-end purchasing process, they’re ticking all the boxes:

Achieve cost savings

Improve operational efficiency

Enhance overall financial performance

Low-cost transactions = big opportunities

Long-tail spend is a pain point for businesses – especially at scale. But, with the right tools, it’s possible to take back control.

Integrating long-tail spend management solutions with virtual cards creates a synergy – they work together to streamline procurement processes, increase control over purchases, and protect against fraud. Most importantly, they lead to cost savings through a reduced need for resources and increased compliance.

If you’re looking to optimize spending procedures and promote financial stability and growth for your business, it might be time to turn your attention to long-tail spend management: The joint solution of AirPlus and Mazepay offers the perfect way for businesses to simplify their indirect procurement processes.

Find out how your business can benefit from our effective long-tail spend management solution.

[1] How Many Suppliers Do Businesses Have? How Many Should They Have? | Forbes.com

[2] Paper Checks’ ‘Long Tail’: What It Takes to Move B2B Into the Digital Age | PYMNTS.com

.jpg?width=375&height=180&name=iStock-1497172728%20(3).jpg)