A success story of over 15 years

Interview with Michael Krenz from Corporate Rates Club

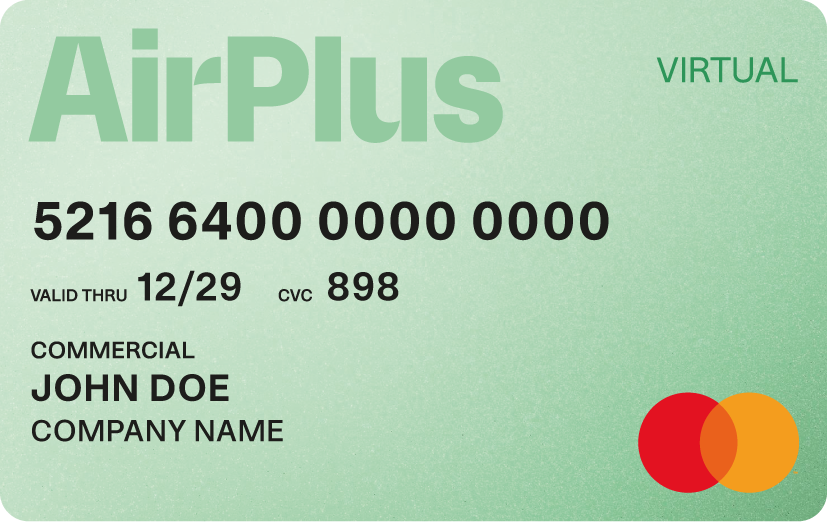

The Corporate Rates Club has been relying on AirPlus virtual credit cards to purchase hotel services for years.

CEO Michael Krenz filled us in on how this came about and why the close cooperation with AirPlus enables an end-to-end process that works over 99% of the time worldwide.

When it comes to booking hotel services for business travelers, the Corporate Rates Club (CRC) is always a good choice: The platform has a selection of over 750,000 hotels worldwide and offers excellent service to not only companies, but also travel agencies and hotels – from booking and invoice verification to central billing.

The CRC realizes its hotel purchasing on behalf of customers with AirPlus Virtual Cards Travel Trade, the digital payment solution from AirPlus. Virtual credit cards enable more efficient and automated processes, while offering more security and transparency, as Michael Krenz goes on to discuss.

But before we go into the current developments, we’ll be traveling back to the time to before digitalization.

So, today we’re asking: How has hotel buying changed over the last 25 years?

Back to the stone age of hotel booking

"In the past, it was common for the business traveler to pay for the hotel service either in cash on site or, in case of doubt, with his own credit card in advance," recalls Michael Krenz, who launched the Corporate Rates Club as a booking platform for business travel in 2000. "When they checked out, they then got the invoice printed out, submitted it to the company with their travel expense report, and had to wait for reimbursement."

Hundreds of paper invoices every day

Back then, there was no talk of digitization or sustainability. Every day, CRC employees received hundreds of paper hotel invoices in the mail for manual review.

The CRC's hotel purchases were mostly made by bank transfer – digital payment flows for hotels simply did not exist at this point. The final technological advance, the crucial digital link to make the entire process more efficient, was still missing.

Early on, the CRC recognized enormous potential for optimization in this process: Incorrectly issued invoices caused considerable extra work for companies. For example, if the provided company name did not correspond to the form required by the tax office for VAT reimbursement, or if hotel services were listed to which the employee was not entitled to.

By taking over invoice procurement and invoice auditing relating to content and tax aspects, the CRC was already able to offer companies a special added value.

Another milestone for the Corporate Rates Club followed at the end of 2006: The cooperation with AirPlus made it possible to completely redesign the purchase and payment of hotel services via a central billing account.

"The introduction of virtual credit cards was a quantum leap for us"

Centralized billing via AirPlus was already simplifying the CRC's accounting, but reconciling invoices was still very tedious: "At the time, we had one large credit card with thousands of bookings on it that we had to reconcile individually," Krenz recalls. "That's why the introduction of virtual credit cards was a quantum leap for us: Suddenly, we could assign a single credit card exactly to every booking and every transaction!"

Virtual Cards: Deposited booking number simplifies reconciliation

Using a virtual means of payment has a decisive advantage: Additional digital data like the individual booking number is already linked to the virtual card when it is generated.

For subsequent payment reconciliation, this means that the billing data is transferred together with the booking number. Which makes this process a lot easier:

Clear allocation

Easy reconciliation

Process automation

"The use of virtual credit cards means an increase in security, greater transparency and much faster workflows," says Krenz.

In the background, a jointly developed XML interface ensures that, in the event of a hotel booking via the CRC, the corresponding virtual card, along with its individual security parameters (such as budget limits), reference details and additional data, is generated directly and automatically.

Comprehensive CRC service as an additional guarantee of success

To ensure that everything runs smoothly, the CRC also provides the hotel in question with information to accompany the booking in advance: "We make sure that the hotel knows exactly which costs may be charged to the virtual credit card," explains Krenz. After all, the booking amount must match the billing amount exactly.

Any additional costs that may be incurred, such as parking fees, WLAN or other services, can also be taken into account much more flexibly when booking with virtual cards – after consultation with the corporate customer.

Virtual cards: Security and flexible budget limits

"This is precisely where a particular advantage of virtual cards becomes apparent: We can increase the card budget by a few percentage points so that the hotel can also bill for additional services. Nevertheless, the card has a limit, so even if the worst comes to the worst, the damage is minimal," says Krenz. "Quite unlike in the past, when the hotelier could actually charge what they wanted via a physical credit card.”

Once the service is rendered, the hotel charges the virtual card on hand. The billing data is digitally transmitted to the CRC, which verifies it and ultimately passes it on to AirPlus for centralized billing to the end customer.

Since the hotel must reconfirm the CRC's acceptance of the costs in advance, this process is safeguarded several times over.

"We have a success rate of over 99 percent - the process works worldwide, no matter where business travelers are traveling," Krenz is pleased to report. After all, AirPlus Virtual Cards are accepted throughout the Mastercard® network worldwide.

We are now regarded in the market as the pioneer for the central payment solution.

- Michael Krenz, CEO of Corporate Rates Club

For the CRC, the complete digitization of its payment process goes hand in hand with a unique selling point that has a very positive effect on new customer acquisition: "We are now regarded in the market as the pioneer for the central payment solution. And our customers also confirm that we offer the best service in this area, which in turn ensures that we are also approached by new prospective customers who did not initially have us in their sights because of our size. We are, after all, more of a small, medium-sized company."

The successful cooperation between the CRC and AirPlus, as well as the joint ongoing product development, is paying off to this day. In addition, another factor ensures that the CRC is looking to a very positive future: The pandemic has enormously accelerated digitization in companies, as Michael Krenz knows from his own experience: "We experienced it during Corona that customers suddenly had time to think about digitizing processes."

And finally, he can't help but highlight the cooperation with AirPlus, which has been in place for 17 years: "I can't imagine a better partner. AirPlus supports us comprehensively in hotel purchasing with its virtual payment solution. Therefore, we also recommend our booking customers to use the central billing solution of AirPlus for their billing of hotel services. It's all-around a provider that simply knows payment and data and has excellent expertise."