Business Travel Trends 2025

2024 was a turning point for the business travel market.

According to GBTA, global business travel spend has surpassed pre-pandemic levels, hitting a historic USD 1.48 trillion last year, with several European countries, including the Nordic region and the Netherlands, actively contributing to this strong recovery.1

It's clear that travel remains an important topic for businesses: Enhancing client relationships, improving partnerships, fostering collaboration - these are all key considerations for a competitive corporate environment.

But there's more to the story.

Based on airline ticket transaction data in our core European markets*, we've identified the latest trends in business travel we'll likely see in 2025.

Quick chapter links

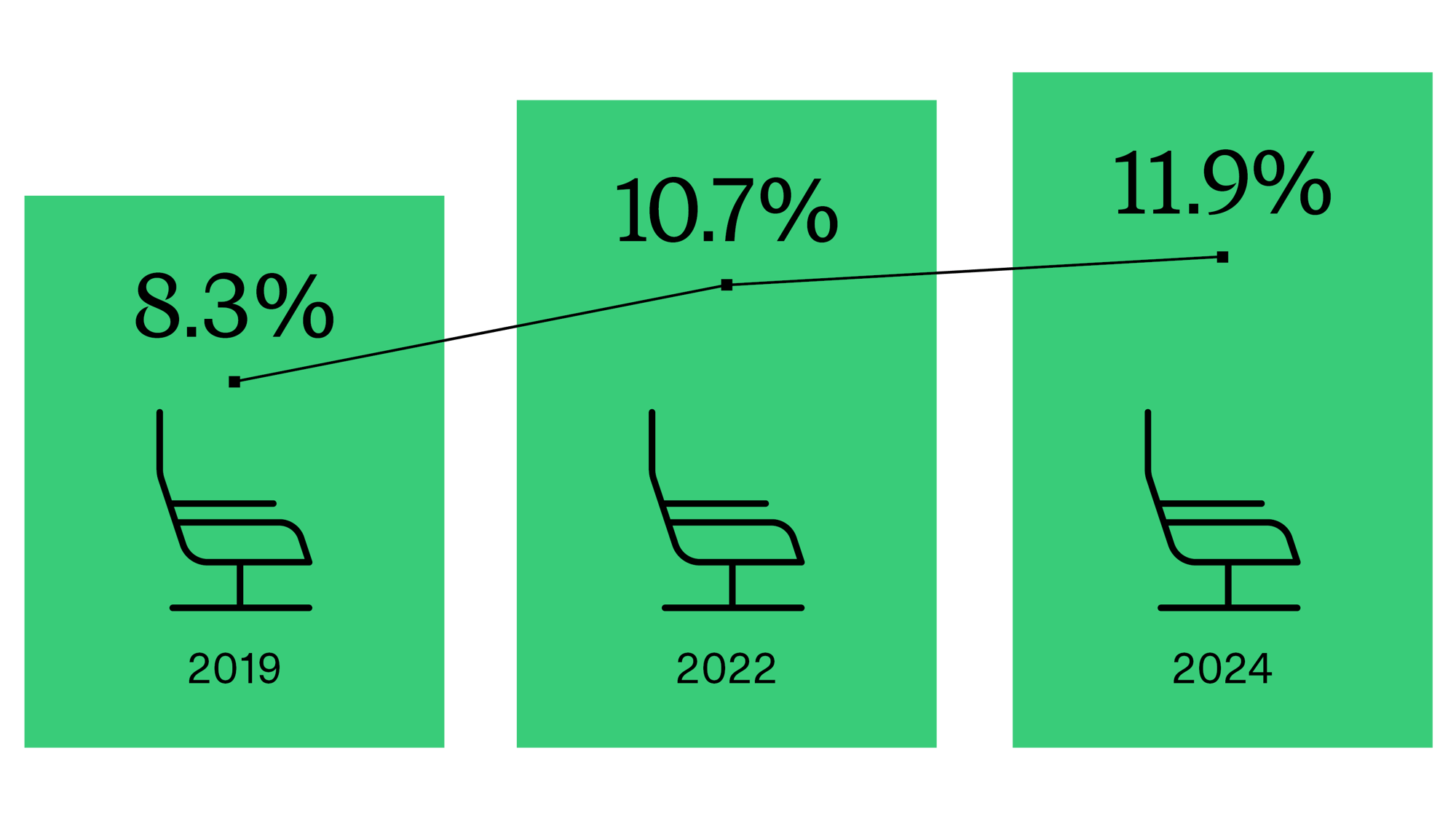

More business class tickets

While economy remains the most popular and perhaps cost-effective class for business travelers, more and more are now opting for business class tickets. Naturally, intercontinental flights see the highest share of travelers (41.5%) opting for greater comfort compared to continental (3.3%) and domestic flights (7.5%).

This trend is also mirrored in Belgium and the Netherlands, with 6.7% and 5.5% of travelers now opting for business-class tickets, while the economy option stays firmly in the lead at 92.1% for Belgium and 93.9% for the Netherlands.

This goes some way to explain why businesses are now paying €220 more on average for their flight tickets than in 2019.

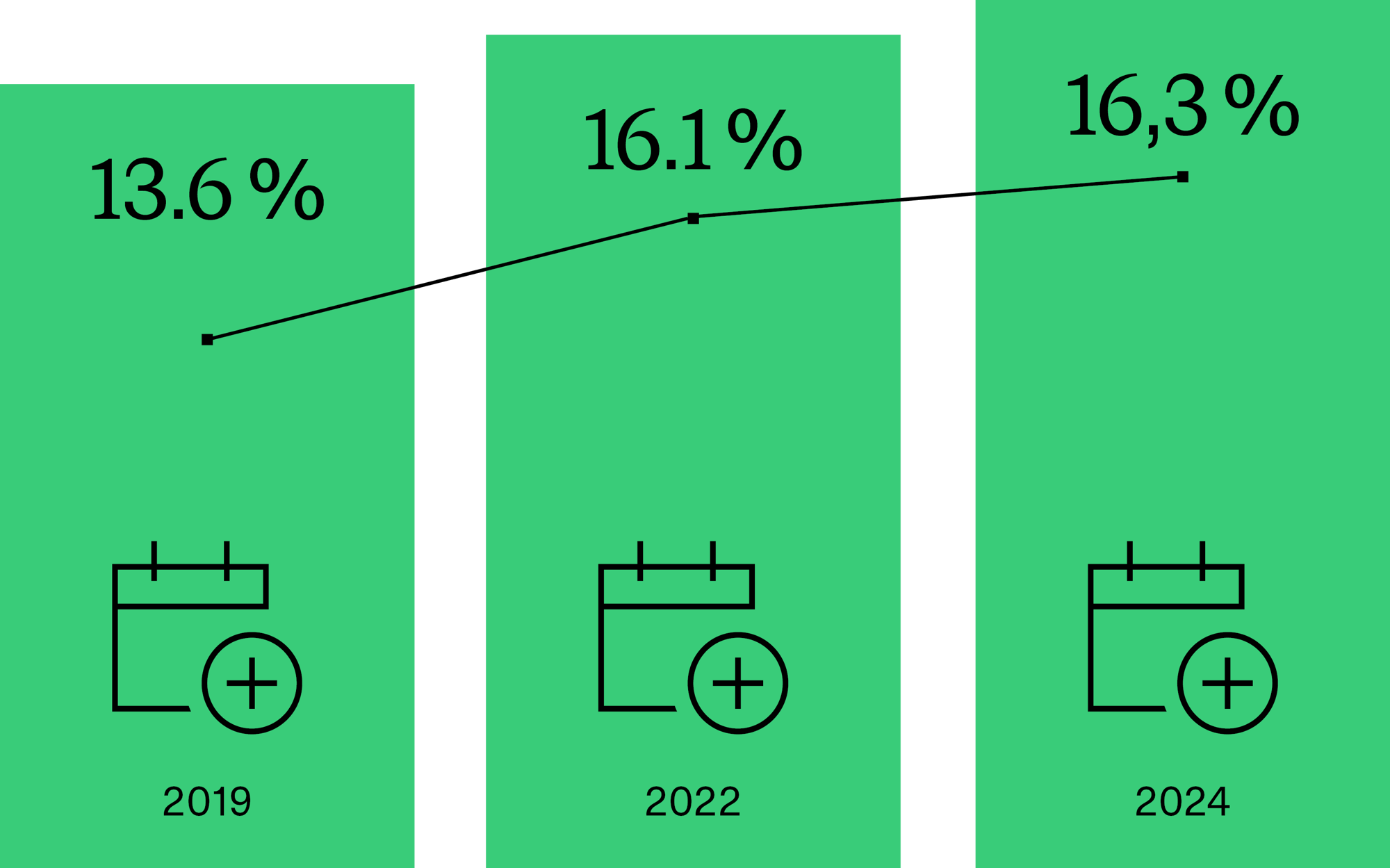

Weekend flights remain popular

Traveling on a weekend is a great way to maximize a trip. Most notably, it's often a sign of business travelers setting aside time to explore a location outside of their work duty – a trend known as bleisure travel.

Compared to 2019, business trips starting on a weekend day have increased with almost 3%. Monday however, remains the top choice for business flights with 31% of all bookings.

And this also remains true for the Dutch and Belgian travelers with 31.6% and 31% opting for Monday as their travel day of choice.

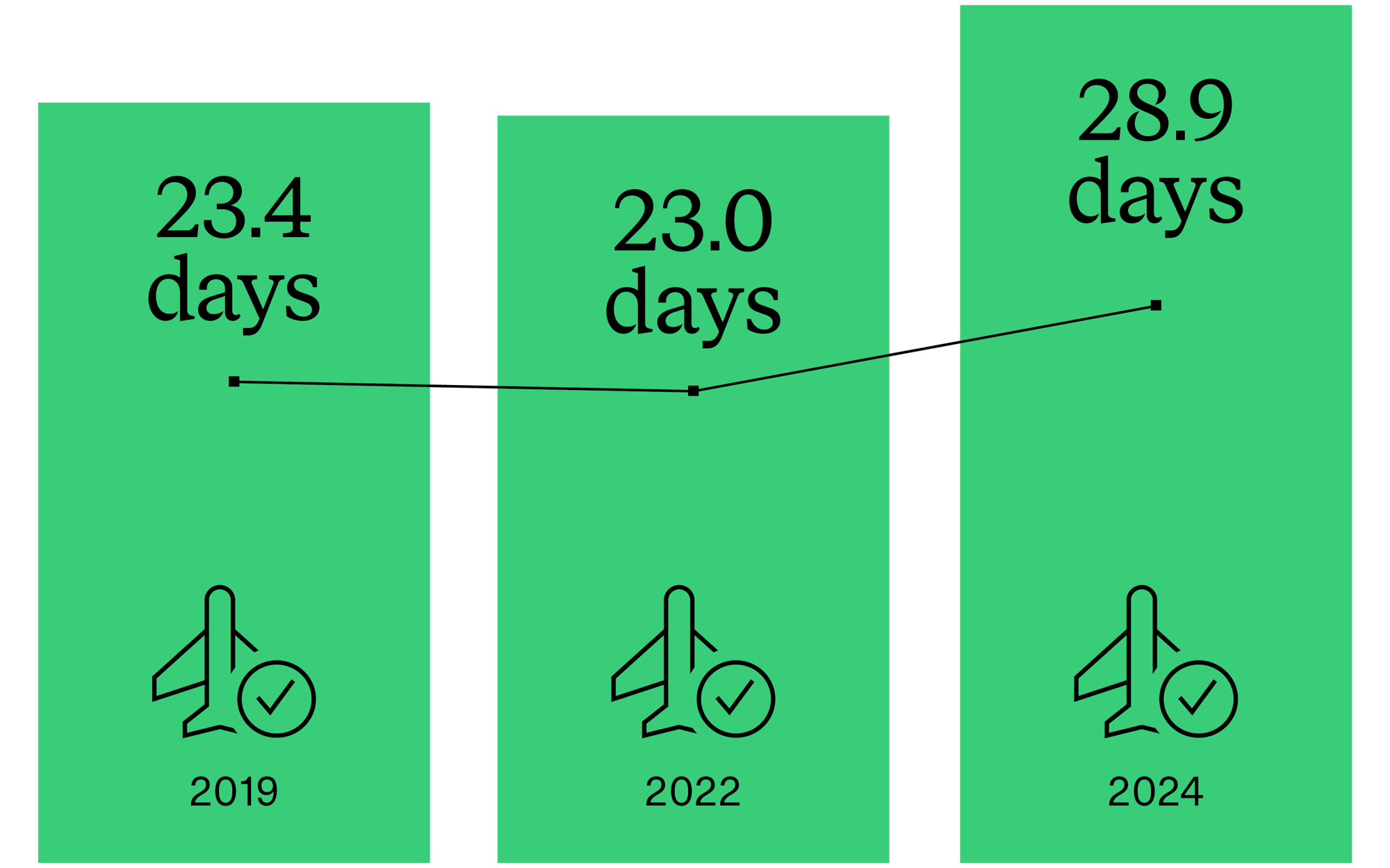

Earlier ticket purchases

Better planning, cheaper prices, more availability – there are many benefits to booking business trips early. And with corporate travelers booking over five days earlier than in 2019, they're becoming more prompt with their bookings than ever.

The trend for advanced intercontinental flight booking continues at an average of 39.2 days in Belgium and 34.8 days in the Netherlands. While for continental flights, the average advance purchase sits at 29.6 days in Belgium and 25 days in the Netherlands.

Intercontinental flights lead the trend, being booked 44 days in advance in 2024 – over 10 days earlier than in 2019.

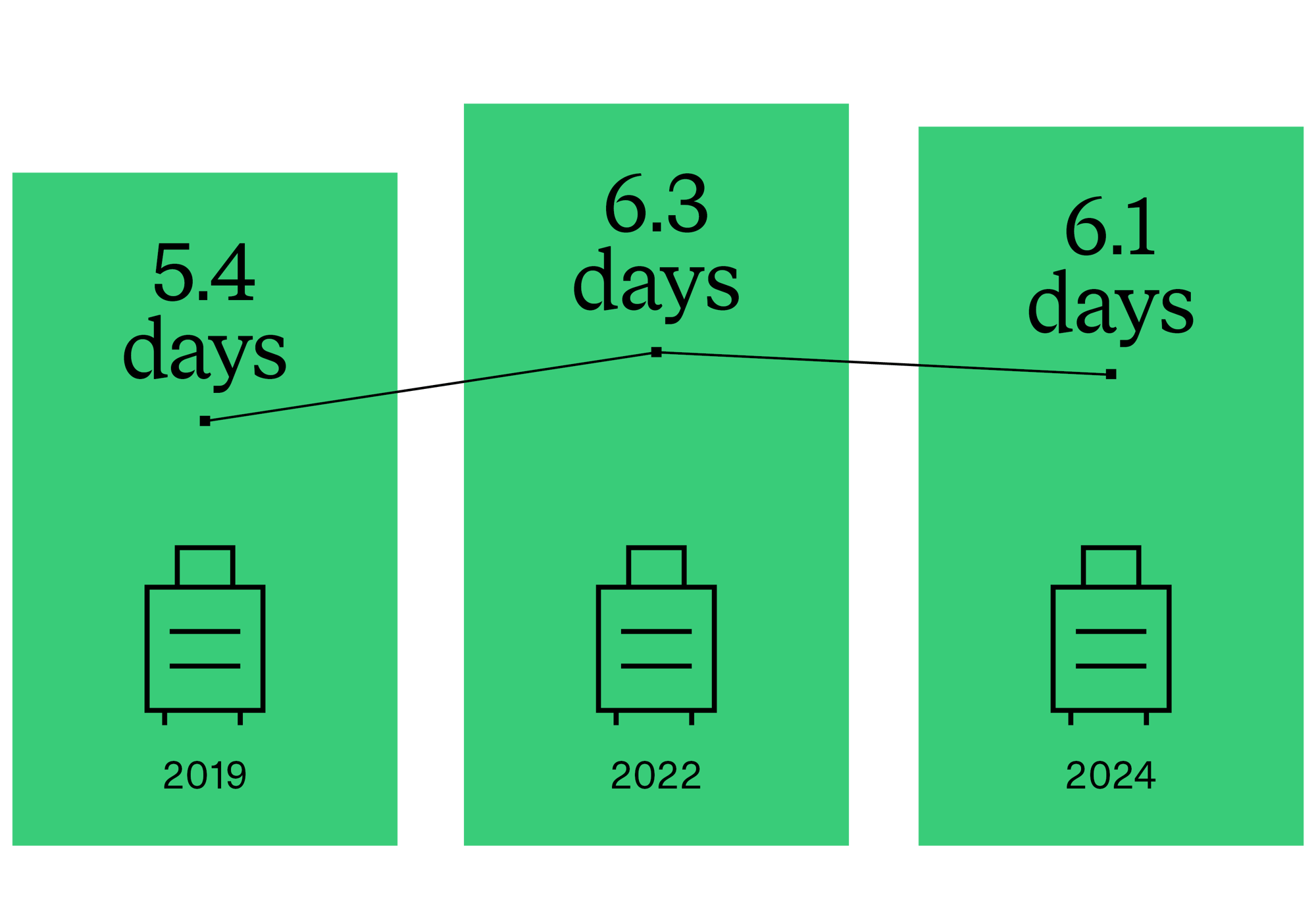

Trip length stabilizing

Over the last few years, we’ve seen a jump in the length of the average business trip. This trend is starting to stabilize with trips now lasting just around six days, down slightly from 2022, but up from 2019.

The duration of business trips in the Benelux averages at a total of 6.4 days.

The reasons for this lie in the rise of bleisure, sustainability efforts, and considering cost savings.

It’s also interesting to note that for intercontinental trips, 21.3% of the tickets booked are for a duration of 14+ days, while for continental trips that figure is at 2.4% on average.

And as businesses become more conscious of the need for sustainable practices, we’ve witnessed a continued drop in one-day trips over the last few years – down from 14.3% of trips in 2019 to just 6.5% in 2024.

Top travel destinations in the Benelux

In 2024, the cumulative distance flown by all flights originating from Belgium was 305,696,504 miles and 895,293,673 miles for the Netherlands.

Continental, Spain was the most popular destination, accounting for 11.9% of tickets booked. This was followed by Italy (11.7%), Germany (10.9%), Poland (7.7%), and then Austria (6.8%) for Belgium.

In the Netherlands, the UK was the most popular destination, accounting for 17.9% of tickets booked. This was followed by Germany (11.1%), Spain (9.8%), Italy (8.7%), and then Denmark (8.3%).

For intercontinental destinations, the United States was head and shoulders above the rest, followed by China, India, the United Arab Emirates, Singapore, and Canada.

Top hotels accepting Virtual Cards as a payment method:

BE - Brussels

- Novotel

- Ibis Hotel

- Doubletree

- Marriott

- NH Hotel

NL - Amsterdam

- Hilton

- Ibis Hotel

- Citizen M

- Yotel

- Holiday Inn

US - New York

- Fairfield Hotels

- Holiday Inn

- Citizen M

- Ace Hotel

- NH Hotel

Discover more in our Virtual Card Data Report.

Moderate growth in European hotel rates

European hotel rates (ADR) are set to rise by 1.9% in 2025, marking a stabilization after post-pandemic surges.

However, economic concerns and the cost of living crisis may dampen leisure demand, increasing availability for business travelers. This could give them more negotiating power as hotels shift focus to transient and group bookings.²

Rise of purposeful, culturally immersive business travel

In 2025 and beyond, it is expected business travelers will increasingly seek personalized experiences that blend work with cultural immersion.

Travel managers are encouraged to incorporate local experiences beyond meetings, fostering deeper connections. This shift enhances both business outcomes and employee well-being.³

NDC driving dynamic pricing and personalized offers

New Distribution Capability (NDC) is reshaping airline pricing with dynamic, real-time models that adjust to market demand. Airlines are using NDC to offer customized bundles and services for corporate travelers.

Though adoption remains gradual, especially among smaller carriers, major carriers are shifting content to NDC channels, impacting fare availability and corporate travel programs. 4

Sustainability and technology redefining business travel

By 2040, sustainability goals and technology will transform business travel. Sustainable Aviation Fuel (SAF), eco-friendly destinations, and greener options like rail will influence corporate travel choices.

Technologies such as AI, VR, and telepresence will reduce non-essential travel, with virtual experiences becoming more immersive.

Real-time carbon tracking and environmental impact scoring will play a key role in travel management, reflecting ESG commitments. 5

* The AirPlus core European markets of Germany, Austria, Switzerland, Belgium, the Netherlands, France, Italy and the United Kingdom were analyzed.

1 2024 Business Travel Index Outlook | Annual Global Report & Forecast | GBTA

2 Travel report: Travel Market Report Q4 2024 | BCD

3 Travel Management 2025 | ATPI

4 Global Business Travel Forecast 2025 | GBTA - CWT

5 2040: Baseline, boom or bust | GBTA - CWT