You fulfill travel wishes, we care about the payment

As a travel company, you have to offer much more than unique travel experiences in the digital age. Whether your customers prefer online booking channels or are still active offline, there's huge savings potential for you in the purchase and billing of travel services that you can now easily tap into.

Meet the digital payment solutions built around the needs of the travel industry

Digitalization is transforming the entire travel industry and posing new challenges for buyers and service providers. At the same time, it's enabling travel companies like yours to rethink booking and billing processes and make them much more efficient.

With digital payment methods such as virtual credit cards, which we at AirPlus have developed specifically for the travel industry, you can enjoy all the benefits of the new digital travel world:

- Simplified payment processes

- Increased transparency

- Reduced risk of fraud

- Secured cash flow for your travel company

- And much more!

Learn more about the latest developments in the travel industry in our blogs, gain interesting insights into the modern merchant model in our e-book, and discover the success stories of other travel companies that already rely on digital payment processes.

We wish you many interesting insights!

FREE WEBINAR

Let‘s get practical: Your travel trade business with virtual payments

Ever wondered how easy it is to integrate a virtual payment solution into your mid- and back-office and global distribution systems? What about the automation of your payments?

Join our experts Sue Ancell and Benny Leipold on 11 June 2024 at 10 a.m. BST/11 a.m. CEST and learn from everyday travel life examples how your travel business can benefit from our virtual payment solutions.

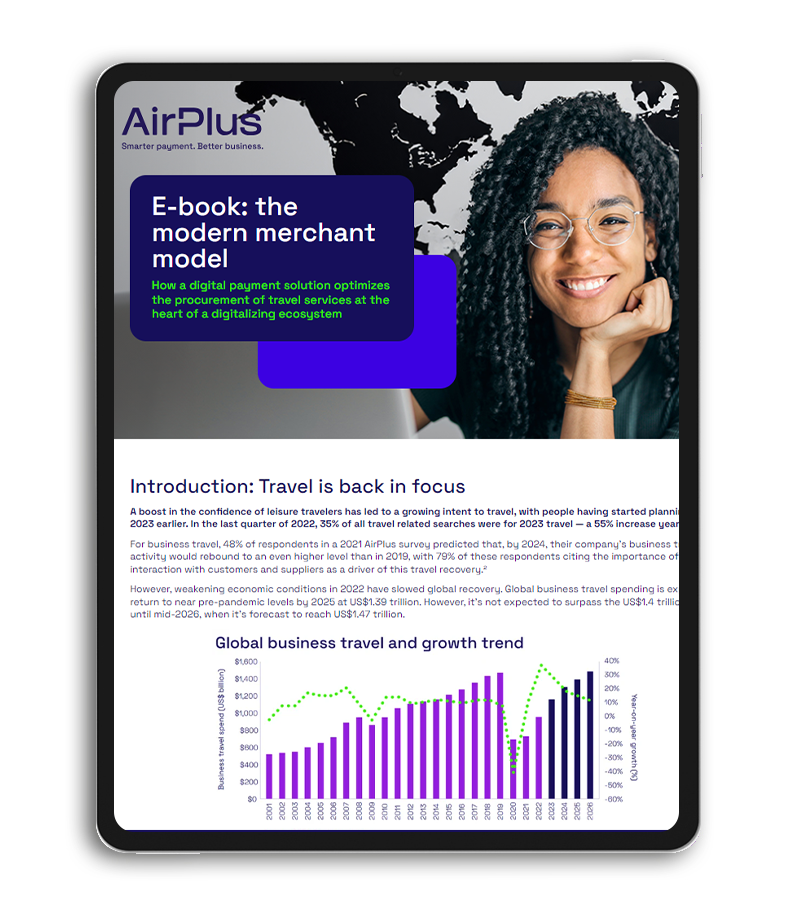

FREE E-BOOK

The modern merchant model

How a digital payment solution optimizes

the procurement of travel services at the

heart of a digitalizing ecosystem

The travel industry is taking off again – and digitization is opening up new opportunities.

Learn more about the latest developments and trends in the travel industry and discover why virtual credit cards are ideally suited to succeed with the modern merchant model in our free e-book.

10 reasons to choose our digital payment solutions

Personalized service

With over 30 years’ experience in the industry, we’re fluent in travel. Our payment experts are available to answer your questions and assist you personally in your local language, ensuring nothing is lost in translation.

Reduced risk of default

With our Mastercard® virtual payment solution, you’re covered in case of default. If your supplier is unable to deliver the travel service (hotel room, flight, train ticket, entrance ticket, etc.) you’ll get your money back.

Better cash flow

AirPlus Virtual Cards enable you to adapt your billing cycle based on seasonal demands. And thanks to central debiting and individual payment terms, you enjoy more flexibility while protecting your cash flow.

Improved data & transparency

Simplify reconciliation and enhance transparency using centralized payments with individually definable data fields. Information such as booking number and PNR is automatically added to your statement with each transaction, reducing the administrative burden.

Enhanced compatibility

Generating virtual cards is quick, easy, and convenient. Best of all, they can be integrated into all common industry solutions, including GDSs, mid- and back-office systems, booking platforms and your very own system landscape, meaning a new card can be generated automatically with each incoming booking.

Easy administration

Via the AirPlus Portal, you can manage and create AirPlus Virtual Cards to pay your service providers in just a few clicks. You’re also able to manage your usage rights and contracts just as easily for maximum control and oversight.

Worldwide acceptance via Mastercard and UATP

With AirPlus Virtual Cards, you can pay worldwide using the Mastercard® network for trouble-free travel industry transactions. Paying service providers is just as convenient via the UATP network, providing high data quality.

Simplified billing

Transferring electronic billing data into your mid- and back-office systems is simple. And with this data at hand, the allocation of all payments from your service providers with the corresponding customer bookings becomes child's play.

Secure payments

AirPlus Virtual Cards are classified as a particularly secure payment solution, so they’re exempt from two-factor authentication. This saves you an enormous amount of time, so you can focus on what matters to you.

Customizable security parameters

Defining the security settings of your virtual credit cards is incredibly easy. And between the validity date, currency, individual card limit and more, AirPlus Virtual Cards give you the control you need to make your card transactions even more secure.

Corporate Rates Club

"The introduction of virtual credit cards was a quantum leap for us. For us, using virtual credit cards increases security, enables more transparency and much faster workflows. I can't think of a better partner than AirPlus – the AirPlus virtual payment solution is comprehensive in hotel purchasing."

Michael Krenz | CEO

Nordic Travel Clearing

"AirPlus Virtual Cards as a payment solution is a vital part of the value we offer our customers when it comes to global reach."

Nordic Travel Clearing

Umfulana

"We automatically generate a new credit card for each payment due and link it to the appropriate hotel and customer booking. The solution offers us a high level of security, as each credit card is only valid for a specific amount and a specific hotel."

Tobias Garstka | MD

eMind Software

"The integration of AirPlus' virtual payment solution allows us to provide an even more efficient and seamless experience for our mutual customers."

Ercan Duman | CEO

Webinar on-demand

.jpg?width=339&height=179&name=iStock-1338044094%20(3).jpg)

Blog

Testimonial

"Umfulana can now implement customer requests much faster thanks to a secure and reliable payment process“

Implementation manual

Webinar on-demand

Blog

Blog

Testimonial

About AirPlus International

AirPlus International is a leading international provider of corporate payment solutions. 53,000 corporate customers rely on AirPlus for the payment and evaluation of their business trips and other purchasing services. The products and services are marketed worldwide under the AirPlus International brand. AirPlus is an issuer of the UATP and Mastercard card schemes. The AirPlus Company Account is the most successful billing account within the UATP.

For more information, visit www.airplus.com.