AirPlus Virtual Cards

Gain transparency, control, and efficiency in your payments

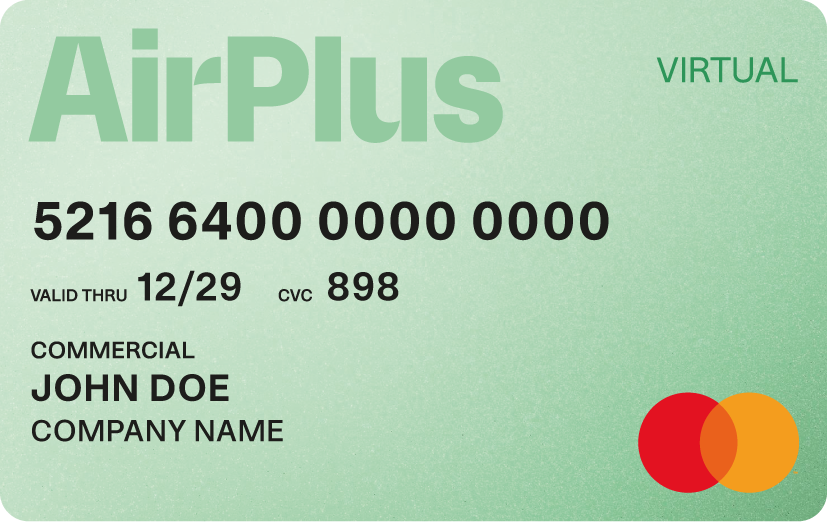

AirPlus Virtual Cards are like your conventional plastic Mastercard®

– but in digital form

Like most credit cards, each of our virtual cards come equipped with everything you need to make a purchase: a unique credit card number, an expiration date, and a card verification code (CVC). This means you can use them to pay suppliers or service providers that accept Mastercard, making it compatible with millions of merchants worldwide.

And that’s not all: You and any of the employees you authorize can generate card numbers at any time, quickly and easily, through the AirPlus Portal. You can even specify a particular period of time, limit, currency, and purpose for each card – a massive gain for security.

All your transactions are then compiled for you into a single, clearly organized statement – including additional information such as cost center or project number – and billed to you together at the end of the agreed statement period.

In short, AirPlus Virtual Cards offer a fast, transparent, and convenient way for making payments.

The right card for every purpose

AirPlus Virtual Cards come in two versions: Single-use and Multi-use.

Your day-to-day challenges and how to overcome them with AirPlus Virtual Cards

“We can’t give every employee a company credit card. Since new employees, interns, and colleagues who don’t travel much don’t receive their own company credit card in many cases, they don‘t have a payment solution from the company. And cash advances are just too big a hassle.”

AirPlus Virtual Cards are perfect in this case. You can restrict the Mastercard credit card numbers that you generate to a specific purpose, such as a stay at a hotel. The term of validity and credit limit can also be set separately for each individual virtual card

AirPlus Virtual Cards can save you time and money. All purchases made with AirPlus Virtual Cards are compiled into a single, central statement with no need for a travel expense report for each individual employee. The additional information supplied for each transaction makes it easier for you to allocate costs later on, meaning less work for the accounting team and the traveler alike.

“Travel expense statements are a lot of work for the traveler, travel manager, and financial accounting department. If expenses are paid using someone‘s personal credit card or cash, it gives rise to a lot of manual work after the trip.”

“A lot of time and effort go into the booking and reconciliation processes. I want as many processes as possible to be automated to streamline these processes and save time.”

AirPlus Virtual Cards are integrated into more than 80 booking platforms. This makes it possible for the whole card generation and payment process to take place seamlessly in the background when you book with your preferred booking engine or back-office system.

“Travel expense statements are a lot of work for the traveler, travel manager, and financial accounting department. If expenses are paid using someone‘s personal credit card or cash, it gives rise to a lot of manual work after the trip.”

AirPlus Virtual Cards Classic can save you time and money. All purchases made with AirPlus Virtual Cards are compiled into a single, central statement with no need for a travel expense report for each individual employee. The additional information supplied for each transaction makes it easier for you to allocate costs later on, meaning less work for the accounting team and the traveler alike.

“A lot of time and effort go into the booking and reconciliation processes. I want as many processes as possible to be automated to streamline these processes and save time.”

AirPlus Virtual Cards are integrated into more than 80 booking platforms. This makes it possible for the whole card generation and payment process to take place seamlessly in the background when you book with your preferred booking engine or back-office system.

Benefits at a glance

Easy as 1, 2, 3

-

Register in the AirPlus Portal.

-

Generate a Mastercard number that can be used right away, whether for an employee’s hotel stay or for purchases made by your IT department.

-

Receive a clear and easily understandable collective statement from AirPlus that covers all your card transactions, rather than multiple individual statements.

Uniquely secure

You can restrict the virtual card numbers you generate to a specific purpose, limit, currency, and period of use.

The card numbers lose their validity after use. Unlike cash or credit cards, they cannot be lost or stolen.

You decide who within your organization is allowed to generate card numbers.

AirPlus Virtual Cards are considered to be highly secure. Card numbers generated for one-time use are therefore exempt from the two-factor authentication requirements.

Keep track of everything

All transactions are compiled for you into a single, clearly organized statement and billed to you all at once at the end of the agreed statement period.

Integrating AirPlus Virtual Cards into your existing finance and controlling systems is quick and easy.

You can use individual additional data fields for detailed information like cost center or order number – perfect for allocating expenses later on.

Keep your cards on file with preferred suppliers to streamline your processes even further.

Thanks to integrations into some of the most popular booking platforms and partner systems, AirPlus Virtual Card generation is both seamless and automated, saving you a lot of time and effort.

Paying with AirPlus Virtual Cards: How it works

-

1. Customer

Before or during the booking process, you generate a virtual credit card via AirPlus and use it to make your payment.

-

2. AirPlus

We receive the booking data, the service provider’s name, and the amount billed via the Mastercard® network.

-

3. Payment

The service provider receives payment from AirPlus immediately.

-

4. Organized statement

All transactions for which you have paid using AirPlus Virtual Cards are compiled for you by AirPlus in a single, clearly organized statement and billed together at the end of the agreed statement period.

.jpg)

More AirPlus corporate payment solutions

Availability of products varies by country due to regional regulations and market conditions.

Please check local AirPlus website for current offerings.