Virtual cards: A winning tool for modern procurement

Why traditional B2B payments don’t cut it anymore

Procurement is increasingly digital. More and more often, virtual payment methods are better equipped than traditional ones like bank transfer and direct debit to solve the challenges that buyers and suppliers are facing today. Yet 69% of participants in a recent AirPlus webinar* maintained that bank transfers are still their primary payment solution. By the end of the session, our message was clear:

It’s time to diversify your payment portfolio with virtual cards.

Our webinar participants aren’t the only ones set in their traditional ways. Kaiser Associates** found that bank transfer still dominated the B2B payment competition in 2020, representing 88% of commercial spend across Europe despite its limitations and despite the growing digitisation of payments in the B2C world. At only 1.4% of spend, cards hold the single greatest optimisation potential for the digitalising procurement landscape.

Most companies are already well aware that as procurement becomes more digital, payment solutions should too. But what many don’t realise is that they’ll need a well managed payment program to navigate the potential complications of a faster-moving, data-richer digitial procurement ecosystem. At the heart of that program: virtual cards.

Traditional payment methods come up short in many ways as the B2B realm becomes digital:

Control: lack of total spend visibility

Compliance: inefficient approval, coordination, and payment processes

Complexity: no centralised management for diverse suppliers

Cost: wasted time and money

While card payments have been on the radar for years in the T&E and business travel markets, most European B2B spend still uses bank transfer.

Yet Europe has the potential to improve – quickly. The continent has a highly developed payment mix and the technical infrastructure to implement sweeping digital reform. This knack for payment diversity is the secret to breaking our habit for traditional banking.

B2B payments poised for disruption

The growth of digital payments in the B2B realm is the inevitable response to the ongoing digitalisation of the wider economy, where contactless, mobile, invisible payments are becoming the norm. The benefits for the corporate sector span both process efficiency (greater control, simpler reconciliation, improved compliance, global acceptance) and financial health (optimised cash flow, extreme fraud reduction). Indirect company expenses are classic hiding places for savings potential, and diversifying your payment portfolio could be the best way to realise it.

The Covid-19 pandemic has also accelerated the drive toward digital B2B payment. With many of us under more pressure than before, companies are looking to optimise tighter financial resources, turning more often to online buying, and jumpstarting the digitalisation of the B2B world. In 2020, the global B2C digital payment market grew by 24% to nearly USD 5 trillion. Physical retail was already declining before lockdowns, while many work-from-home models are here to stay, meaning more employees will be making company purchases remotely.

It’s time to question bank transfer as the only B2B solution

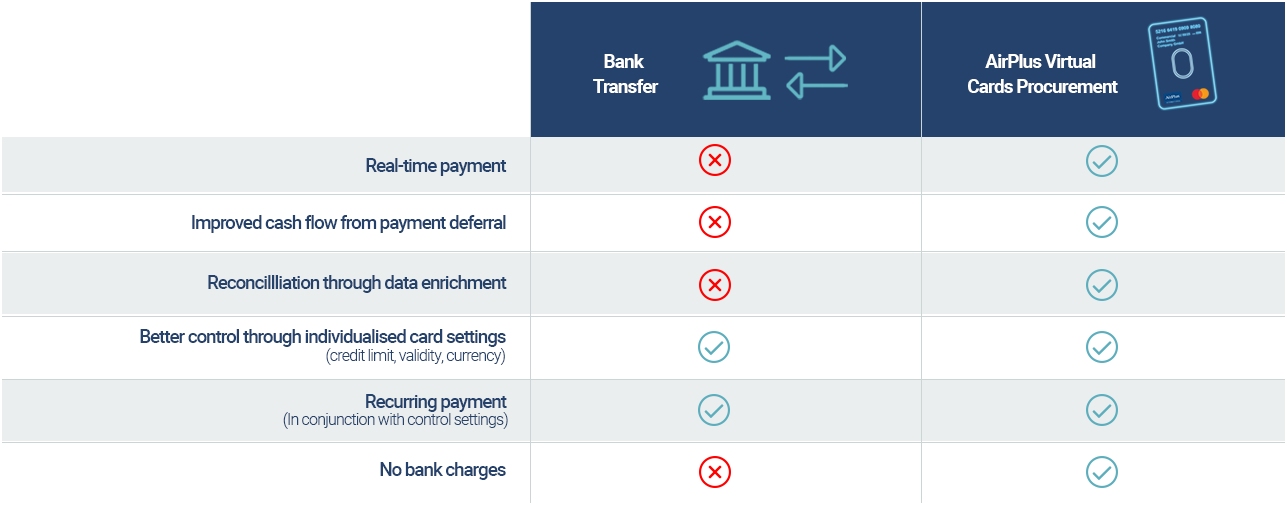

Virtual cards offer longer payment terms, higher data quality, and better reconciliation. AirPlus Virtual Cards Procurement even enable you to set and automate recurring payments. In the digital arena, bank transfers can’t compete.

Growing working capital needs are also changing how companies want to pay suppliers, as more companies are strapped for cash and looking to settle transactions quickly without drying out cash flow. Opting for solutions that quickly settle with suppliers but offer extended payment terms relieves the burden of more rapid payments within digital procurement. This is a particular benefit of centralised payment solutions like AirPlus Virtual Cards.

Centralised solutions enable merchants and suppliers to be paid for transactions immediately while the companies receiving the goods and services are charged later, at agreed-upon intervals. These optimised DSO and DPO conditions can ease the burden on your company by satisfying your suppliers with quicker settlement while offering you extended statement terms for your own withdrawals. That means more cash flow in the company coffers and more working capital in your pockets for daily business.

Virtual cards as a supply chain finance solution

Supply chain finance is another area of procurement where virtual solutions play an important role. Unlike other supply chain finance solutions such as dynamic discounting, factoring, and reverse factoring, virtual payments come without additional costs, transaction fees, and third party intermediaries. They enable an extention in DPO as well as a decrease in the DSO of your suppliers. Superior data quality also greatly improves the reconciliation process, a classic way to save time and money.

Introducing digital solutions comes with significant benefits for savings, capital, and convenience… but only if harnessed with the right payment methods. Solutions like AirPlus Virtual Cards Procurement centralise all your diverse payments and bill your company with a single statement, maximising flexibility and putting you back in control of the digital procurement process. The richer transaction data of AirPlus Virtual Cards Procurement enable the best of both ends of the payment spectrum – from flexibility and convenience when buying to visibility and control at billing.

* AirPlus survey of 238 corporate professionals, Nov. 2020

** Kaiser Associates, CGS