ChatGPT’s top 5 payment trends for 2023

Payments have been through many changes over the years. From the first coins being minted thousands of years ago to the likes of mobile, digital and crypto payments, the landscape of today is a reflection of technological and cultural progress.

To help keep track of what’s going on in the market, we have compiled a list of the latest payment trends to look out for.

So, what are the latest payment industry trends for 2023?

Why ask ChatGPT?

This time around, we wanted to do something a little different. As we have previously done with business travel, we asked ChatGPT what to expect in 2023 when it comes to payments.

We described how it works in that previous article, but here's a summary:

ChatGPT is an AI model by OpenAI that users can interact with like a chatbot. What makes it so special compared to similar models and even previous iterations is its ability to understand the intent behind questions and statements.

Notably, the AI chatbot does not source responses from the internet, instead using data and information it was fed during the training phase back in 2021. That’s a disadvantage worth noting for our topic today – it cannot draw any new context or data from the last couple of years.

So how well will it perform?

Once again, we'll be providing our response to the ChatGPT predictions to see how viable they are and whether they align with our views of potential 2023 payments trends.

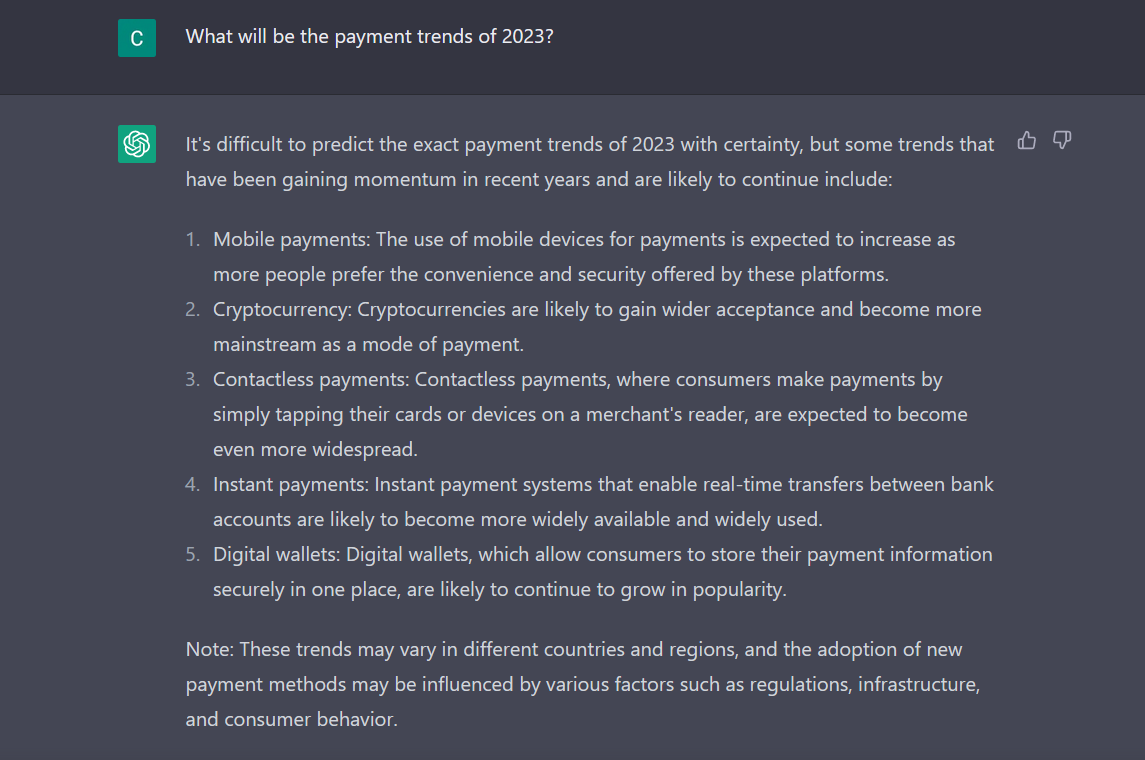

Here's what ChatGPT had to say about payment trends in 2023.

Top 5 payment trends by ChatGPT

It's difficult to predict the exact payment trends of 2023 with certainty, but some trends that have been gaining momentum in recent years and are likely to continue include:

As always, ChatGPT prefaces its predictions with a word of caution about the difficulty of forecasting market trends.

Smart move.

What's also smart is focusing on ongoing trends that appear to be taking off – always a safe choice.

1. Mobile payments

Mobile payments: The use of mobile devices for payments is expected to increase as more people prefer the convenience and security offered by these platforms.

By the end of 2025, the total number of mobile wallets in user is projected to increase by almost 74% to reach 4.8 billion. [1]

More than half the world’s population is expected to be using their mobile for payments in just a few short years. It’s easy to see why, with most people owning a device and carrying it with them everywhere they go.

While China remains the biggest market, Africa, the Middle East and Latin America are starting to catch up. And with their populations also growing alongside this mobile payment infrastructure, it makes sense that this trend will continue to grow.

See our ultimate guide to mobile payments to learn everything you need to know about this trend.

And with our very own AirPlus Corporate Cards now being available to use in Apple Pay, we are very much a part of this trend.

2. Cryptocurrency

Cryptocurrency: Cryptocurrencies are likely to gain wider acceptance and become more mainstream as a mode of payment.

The use of digital currencies like Bitcoin and Ethereum skyrocketed during 2021, along with the blockchain technologies that support them. Additionally, the crypto and blockchain sector has attracted nearly $19.4 billion in venture investment globally since 2017, with over 40% of that figure ($8.6 billion) coming in 2021. [2]

However, we need to address the elephant in the room: 2022 saw a big drop in the market that is only now starting to recover – a recent reminder of the uncertainty the market presents.

Even so, there's still plenty of positives: Notable crypto payment processor BitPay saw average crypto monthly transactions rise from 58,000 in 2021 to 67,000 in 2022. [3]

Crypto payment acceptance also saw an increase, with notable brands like Gucci beginning to accept payments in the digital currency. Even traditional payment companies throwing their hats into the crypto payments ecosystem. We've looked into how crypto could impact business payments before, so check it out to learn more.

It just goes to show that anything is possible in the future – especially so for cryptocurrencies.

3. Contactless payments

Contactless payments: Contactless payments, where consumers make payments by simply tapping their cards or devices on a merchant's reader, are expected to become even more widespread.

Contactless payments are possible thanks to progress seen in both POS solutions as well as card technology. But it was the pandemic that really pushed the transition to contactless forward.

Data from the European Central Bank shows that the number of contactless users jumped from 41% of all card payments in 2019 to 62% in 2022 – a significant increase. [4]

The data speaks for itself, and we are all likely familiar with the context this growth happened. This no-touch payment habit has stuck around for the most part. After all, contactless payments go hand in hand with mobile and wearable-based payments.

4. Instant payments

Instant payments: Instant payment systems that enable real-time transfers between bank accounts are likely to become more widely available and widely used.

Instant, real-time payments have plenty of benefits. The real-time payment standard has begun to garner attention and, more importantly, adoption by businesses.

Account-to-Account (A2A) payments are part of this trend and are expected to represent one fifth of all e-commerce payments in Europe by 2023.

This is being driven by feasible alternatives to credit cards, the regulatory tailwinds of PSD2, and exciting new innovations in technology.

A2A payments happen via bank transfer and are extremely beneficial for merchants as they eliminate ties to card monopolies and see fewer chargebacks. Integration into banking infrastructure means lower costs per transaction, with seamless customer experiences and secure authentication.

5. Digital wallets

Digital wallets: Digital wallets, which allow consumers to store their payment information securely in one place, are likely to continue to grow in popularity.

Digital wallets or e-wallets remain a preferred payment method among global e-commerce consumers, registering 44.5% of global e-commerce transaction volume in 2020, an increase of 6.5% from 2019.

By 2024, digital wallets are projected to represent 51.7% of e-commerce payment volumes. [5] This trend is being sparked by their inherent suitability for mobile commerce, their seamless integration with social media and the rise of 5G.

Digital wallets are also benefiting the other trends this year. For example, mobile payments and cryptocurrencies often utilize digital wallets in one way or another. Think of this as the culmination of the 2022 payment trends.

Regulations, infrastructure and consumer behavior

Note: These trends may vary in different countries and regions, and the adoption of new payment methods may be influenced by various factors such as regulations, infrastructure, and consumer behavior.

This note is actually very important.

It’s understandable that different markets and cultures have their own local trends. But as ChatGPT has highlighted, regulations, infrastructure and consumer behavior each play a significant role. Let’s break it down.

Regulations

Regulations like e-invoicing or PSD2’s strong customer authentication requirements have thrown a spanner in the works when it comes to offering a more frictionless payment experience.

However, the development of the subsequent PSD3 looks to change this – supposedly focused on enhancing the user experience to allow for less invasive authentication. [6]

Infrastructure

The basis of tomorrow’s payments architecture will revolve around firms opening to integration and offering shared services with other firms in their ecosystem. The core of this system will be supported by a services portfolio that will help enable tailor-made sector specific customer solutions.

These payments systems will not only offer native technology, but also integration modules, APIs and cloud-based distributed data.

They can integrate a portfolio of services into a shared payment processing infrastructure, digital identity databases and other shareable registries. These services can speak to the core via API calls. Payments-as-a-Service also represents this ongoing shift.

Consumer behavior

Consumer behavior will always be the trend setter for the wider payment market. In recent years, B2B payments have begun a kind of consumerization, bringing business payments in line with what the public is experiencing. There are a couple examples of this we wanted to highlight here: BNPL and embedded payments.

BNPL

The BNPL (buy now, pay later) trend seems to have suddenly jumped onto the payment scene over the last few years. In retail, Buy Now Pay Later options will be further explored as inherent to embedded finance, driven by Gen Z and Millennials looking for convenience and low-interest options.

In 2022, consumer spending that involved BNPL platforms reached $112 billion globally. Pretty sizable, but some estimates for 2027 are expecting growth in the region of 291% to $437 billion. [7]

This is also a growing trend in B2B, with SMBs looking to optimize their supply chain financing. [8]

Embedded payments

Frictionless and embedded payments, where the payment process is integrated seamlessly into the customer journey, are now expected by consumers as they seek simple, low-cost payment solutions.

Embedded payments are expected to go mainstream with the market size being estimated to reach $7 trillion by 2026 [9], with the most explored sectors being food delivery, ridesharing and in-car payments.

Payment trends that ChatGPT missed

The payment market is too big and dynamic to summarize in a handful of greater trends. And, as mentioned, ChatGPT erred on the side of caution with relatively safe choices – macro-level trends rather than focusing on the small stuff.

As such, there are some aspects that ChatGPT wasn’t able to pick up on for whatever reason that are worth mentioning.

Data and cloud integration

The utilization of data and cloud technology are likely to rise in the coming year and beyond.

For example, as Open Banking continues to mature across more markets, it is playing a key role in facilitating frictionless payments and enabling customers to move money internationally at speed and low-cost, removing the administrative burden of traditional bank transfers.

Greater insight into transaction data is also driving this trend but is not yet being monetized by many.

Creating value from data is essential to survive, but only 40% of the surveyed banks have been monetizing transaction-based APIs for a long time. The widespread adoption of the ISO 20022 standard is looking to change this by increasing interoperability using structured data.

Sustainability

The topic of sustainability in payments is likely to be prevalent for years to come as regulations and pressure from the public make it a priority.

ESG is a topic that often comes up when talking about sustainable finance amongst businesses, as their actions to become more environmentally friendly (amongst other things) are often correlated to their financial success. [10]

Sustainable payment options are often overlooked. Thankfully, our AirPlus Company Account product offers a green way for businesses to pay for their business travel needs. Otherwise, carbon offsetting is expected to take off as a way of offsetting unavoidable carbon emissions derived from payment activities.

A turning point for payments

Once again, ChatGPT performs well in reading the market and predicting the trends coming this year. We very much agree with the AI’s outlook, though it did give a more succinct list than we would have hoped. Still, we walk away very impressed.

To summarize, payments nowadays are no longer defined by just their speed or ease – the crucial element post-pandemic is that they’re becoming more invisible and embedded, enabling a frictionless customer experience.

The line between the B2C and B2B payment markets are growing ever thinner, as payment experiences at home begin to make their way into business workflows.

However, companies will likely always have more complicated needs when it comes to payments – and this overarching trend of consumerization is helping to make it just that bit easier.

Let’s see how the year progresses.

Can’t wait to find out more? Subscribe now to our global newsletter ready for the next release.

Banner photo by Jonas Leupe on Unsplash

[2] https://www.financedigest.com/the-year-ahead-top-payments-trends-to-watch-out-for-in-2022.html

[3] https://www.blockdata.tech/blog/general/the-state-of-crypto-payment-providers-in-2022

[4] https://www.ecb.europa.eu/stats/ecb_surveys/space/html/ecb.spacereport202212~783ffdf46e.en.html

[5] https://thepaypers.com/reports/the-payment-methods-report-2021/r1250527

[7] https://www.juniperresearch.com/press/press-releases/buy-now-pay-later-spend-to-accelerate-reaching

[8] https://prod.ucwe.capgemini.com/wp-content/uploads/2023/01/Top-Trends-Payments-2023.pdf

[9] https://prod.ucwe.capgemini.com/wp-content/uploads/2023/01/Top-Trends-Payments-2023.pdf