Sense and solidarity: The unprecedented policies of pandemic

Jane Austen published her first novel Sense and Sensibility in 1811. The book compares rationality and intuition as approaches to the challenges of life, but doesn’t pick a side. Human nature is complicated, the book seems to say. Seven years later, the first of seven Cholera pandemics circled the globe. The century would be defined by budding globalization: common identity as defined by common challenge. 200 years later, in the midst of a new global pandemic, we once again look to make the most of our complicated human nature.

Governments around the world have scrambled to implement temporary policy changes to mitigate the negative economic effects of the coronavirus pandemic. Where will it lead? [i]

Governments around the world have scrambled to implement temporary policy changes to mitigate the negative economic effects of the coronavirus pandemic. Where will it lead? [i]

Just a few months into the crisis, with unemployment on the rise and no end to infections in sight, it was clear that the economy was in uncharted waters. The level of stimulus support has since risen above anything we’ve ever seen. In a move that surprised many, the government of Germany, AirPlus’ home country, recently announced a reduction to its value-added tax (VAT) rates. The industry has rushed to meet tight deadlines and make sure the potential benefits of the relief effort would be passed on to customers with as little interruption as possible.

A global economic response

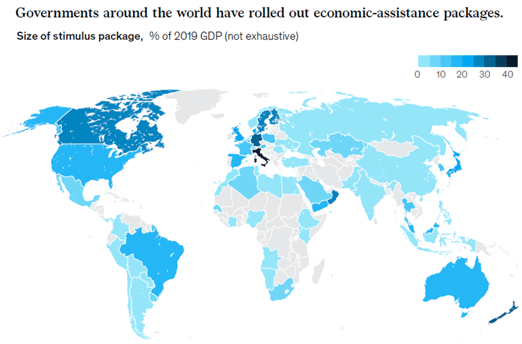

The VAT in Germany reduction is just one step in a series of economic maneuvers across Europe and the world. As early as April, the European Council recognized the Covid-19 pandemic as an unprecedented challenge with very severe socio-economic consequences.

“We are committed to doing everything necessary to meet this challenge in a spirit of solidarity,” said the Council in a press release at the time.

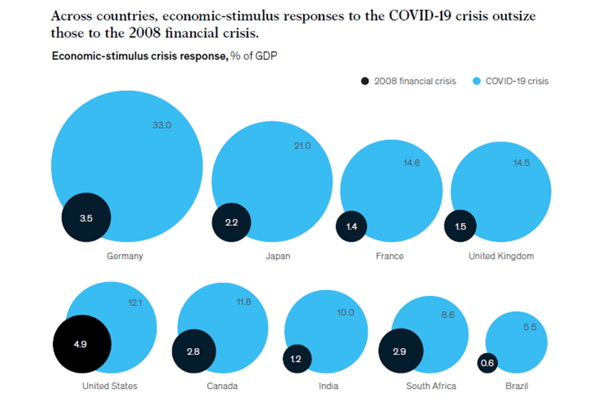

So what does “everything necessary” look like? Communities and governments around the world have thrown their weight into comprehensive policy challenges that have amounted to the largest stimulus responses in history.

The global policy response to the Covid-19 crisis has outstripped that of the 2008 banking collapse many times over. [ii]

Planting the seeds of recovery

While the European Council has invoked a spirit of solidarity, governments, institutions, and businesses around the world have implemented their own short, medium, and long-term initiatives based on their perspectives of the best chances of a strong recovery. How to stimulate international economic activity is far from a science. The diverse measures taken have complicated already complex connections between domestic and international economies and the confidence that keeps these relationships stable and healthy. In an effort to encourage spending, Germany opted for a sales-related tax reduction.

Putting the short in short-term policy

In early June 2020, in the midst of the economic turmoil, the German government announced a further domestic fiscal stimulus package that included a significant reduction in VAT. The temporary reduction began on July 1 and is scheduled to last until December 31. That left companies who charge and claim VAT (like us) only a handful of weeks to implement the changes.

“The short notice has made it very challenging,” said Birgit Weidemann, Head of Product Management at AirPlus. The last time a VAT change had to be implemented, she said, the team had over a year to prepare.

Invoices had to fulfill the requirements of the German tax authorities by the July 1st deadline. Our project team went into overdrive to pull it off, along with so many others around the country. Since implementation, customer service has taken the torch, tackling confusion and ironing out wrinkles in the revamped billing process.

If you’re an effected customer, or have any questions about the recent changes, don’t hesitate to get in touch.

With the country changing policy virtually overnight, there are bound to be hiccups, but the spirit of solidarity has gone a long way in ensuring continued strong relations in our industry and beyond.

Weidemann reflects that the AirPlus team has had some recent practice with tight tax deadlines: last year, our Chinese office rushed to change its VAT procedures with only five weeks’ notice from the Chinese government. This summer, under the enormous pressure of the pandemic, Germany offered an even narrower window of just under a month.

But the relief package promises a positive effect across the industry and the efforts have been well worth it. With Covid-19 infection rates still climbing around the world, it’s clearer than ever that economic stability is only one facet of our current global struggle for health and security. From the business travel perspective, clear rules can go a long way to making travel safer. Austrian Airlines, for instance, recently required negative test results to fly.

We are in this together. [iii]

We are in this together. [iii]

The nitty gritty of the deal

Across Germany, VAT has been reduced from 19% to 16% for standard rates and from 7% to 5% for items already set at reduced rates (such as medical supplies, books, and domestic transport). All AirPlus customers who are charged German VAT on our paid products and services have enjoyed these lower rates since July 1.

The cost of the German fiscal package is a whopping €130 billion, which is in addition to the policy changes earlier in the year that totaled €156 billion. The policy experts at the Tax Foundation have calculated that these two initiatives alone amount to over 7% of Germany’s entire GDP from 2019.

We don’t know for sure what all will come of our global efforts to steady the economic ship, but this at least is clear: 2020 will be a year long remembered.

[i] Photo by AbsolutVision on Unsplash

[ii][iii] mckinsey.com/industries/public-and-social-sector/our-insights/the-10-trillion-dollar-rescue-how-governments-can-deliver-impact