The 3 Ps of today‘s

MICE Picture

For your future corporate

payment strategy

The 3 Ps of today‘s

MICE Picture

For your future corporate

payment strategy

Europe dominates

the global market of

Meetings

Incentives,

Congresses and

Exhibitions.

In Europe we see the highest number of international association conference participants in the world.

Source: The European market potential for MICE tourism | CBI

50%

With a market share of 50%, Europe is expected to keep this position until 2030.

ROI is crucial

Maximizing M&E spend is essential to continue to engage and build loyalty with customers, employees, and members.

Source: Strategic Meeting Management in a next-gen world | MPI.org with Cvent

74%

of meeting professionals consider events to be their most important demand-generation tactic.

76 %

of meeting professionals view business conditions for events increasingly positive for the rest of 2024.

That‘s up 6%

over last quarter.

Source: meetings outlook winter 2024 | mpi.org

22%

of surveyed European event planners expect budgets to be at least 20 % higher in 2024.

Source: Cvent 2023 Planner Sourcing Report Europe

Talking about spend:

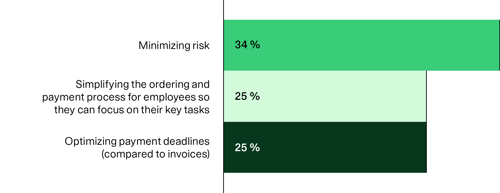

The most pressing corporate payment issues

to tackle for European finance leaders:

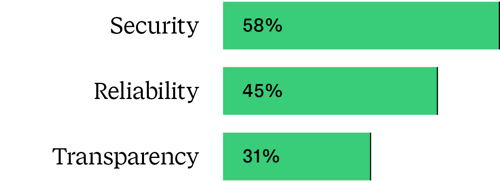

The most important payment solution features are:

“Training activities” is in the top 3 of commodity groups, and represents:

→ for 30 % of the finance leaders, a challenge in the payment process

→ for 26 % a commodity group that requires prompt payment.

Source: AirPlus survey among 534 finance leaders from Austria, Belgium, France, Germany, Italy, Luxemburg, Netherlands, Switzerland, and the UK.

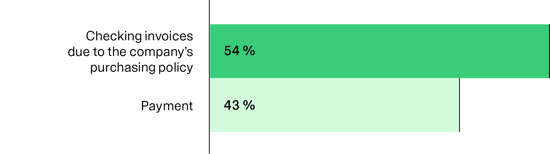

The majority of the European finance leaders see inefficiencies in the process of:

Contracted suppliers

→ Main challenge: Too much manual

administrative effort is needed

→ Top 5 of main causes

of manual administrative effort:

1. Invoice handling

2. Compliance e.g. "ESG" (Environmental, Social, Governmental)

3. Reconciliation

4. Dispute / claim handling

5. Payment

Source: AirPlus survey among 534 finance leaders from Austria, Belgium, France, Germany, Italy, Luxemburg, Netherlands, Switzerland, and the UK.

Non-contracted suppliers

→ ~ 43 %

= average total purchasing volume that goes to non-contracted suppliers

→ Main challenge for 52 %

of the finance leaders:

Ensuring compliance in purchases

When your company‘s next MICE booking requires a prompt and high amount (down) payment, payment process efficiency matters more than ever.

Discover how to optiMICE your payment strategy with AirPlus.