How to save up to €11 per transaction

Optimizing travel expenses while improving expense management goes hand in hand. Significant savings can also be achieved by implementing the right tools. Here are some interesting avenues to follow.

Big data is at the heart of every area of your company. Making better use of the wealth of data produced by your processes, which are increasingly automated, is an integral part of any strategy to increase efficiency and savings. Business travel is no exception to the rule, with the rise of centralized payment solutions, automated expense reporting, and diversified payment methods like corporate cards.

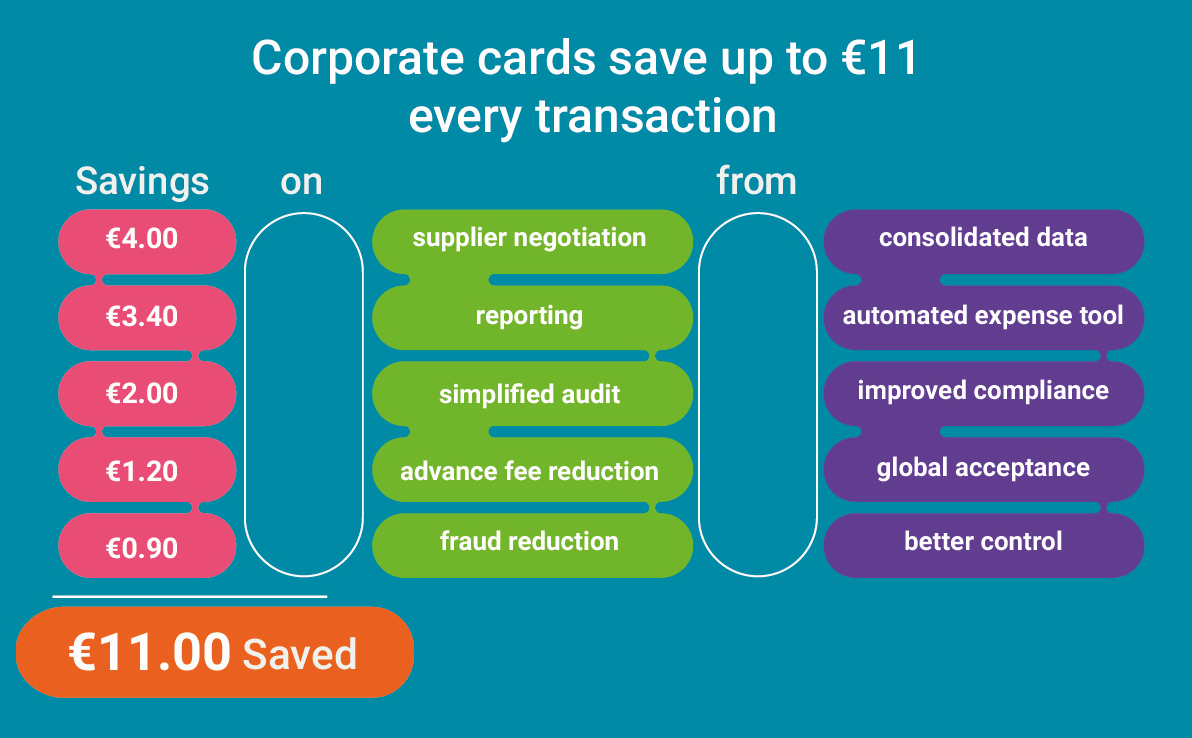

The large-scale PayTech Commercial Client Database 2009-2015 study discovered that a company can save an average of €11 for a €135 transaction by implementing an automated expense claim processing system using a corporate card. We’ve detailed below exactly how these savings would attained. The best way to adopt corporate cards is to consider its implementation as a project, with all the organizational efforts that implies.

- €4 per transaction come from better negotiated rates with suppliers thanks to consolidated payment data. Travel managers rate data usage among their top priorities, with 63% considering it in analyses and comparisons (CWT Travel Management Priorities 2015).

- €3.40 per transaction is the amount of savings achieved by automating the expense claim process. This makes sense, as automation will reduce the time previously spent on processing paper receipts by 40%. The outdated process is much more time-consuming and invites input errors that must later be rectified. Finally, the entire processing chain is a source of savings, since the time taken to process claims is also reduced by 25%.

- €2 in savings per transaction are made possible by employees better monitoring the travel policy. According to the Aberdeen Group 2014 survey, the rate of compliance with the company's travel policy rises to 91% when processing is highly automated with corporate cards. Another perk: fewer security checks mean more time saved.

- €1.20 reduction per transaction can be attributed to fewer advance fees, which are negated by corporate cards in an automated management system.

- €0.90 savings per transaction are saved thanks to a significant reduction in fraud with the implementation of an automated expense claim management system. According to a 2018 survey by the accounting firm wity.fr, 30% of employees surveyed said they had given into the temptation to inflate their travel (60%), meal (50%) or accommodation (43%) expenses.

.jpg?width=375&height=180&name=iStock-1497172728%20(3).jpg)