The value of online B2B purchases: visible or yet to be unveiled?

It has global reach, it’s cost-effective, and it’s available 24/7. What is it?

You guessed it right, it’s the Internet as an online buying channel, in an e-commerce economy that has developed rapidly over the last few years.

Online shopping has proven to be more and more convenient for us as consumers. The trend of online transactions between two businesses — or B2B purchases — has been growing too, due to the maturation of digital capabilities and global events like the recent pandemic.

During that period of lockdowns and social distancing, besides buying and deploying telecommunication software company-wide for their remotely working employees, companies also needed to pay the bill for other ad hoc and one-off necessities for the continuity of the day-to-day work.

Those necessities didn’t fit well in the category of company-wide needs since they often involved specific demands on the employee or team level. Examples of this are design or other application software services, stock photos, or specific equipment like headphones, purchased at online suppliers or marketplaces such as Amazon to which the employees had found their way already as consumers.

Today the hybrid way of working still exists, and the payment landscape is still changing with suppliers becoming more diverse and many of them are in the process of modernizing, digitizing, and moving to online channels. These developments have implications for the corporate payment process in your company too.

How can your company best navigate through this ever-changing landscape and bring value to your online B2B purchases without losing them out of sight?

Let’s dive in.

Managing online B2B transactions: an investment in the inevitable

The term used to refer to ad hoc, one-off nature of spending on mostly low-value transactions — including subscription and recurring payments — is ‘long-tail spending’.

Long-tail spending online by an employee is often with a non-strategic supplier that’s not in the company’s database and therefore undermanaged or even excluded from category management. Given the nature and low value of long-tail, it is considered simply not worth the effort to go through extensive negotiation cycles.

That’s why, the employees or teams in need of the particular long-tail good or service often advance the payment personally with their own or their supervisor’s credit card, bypassing corporate procurement policies.

As a consequence, no centralized payment trail is available or a directly traceable cost overview. The finance team will probably only get a glimpse of the costs if and when the reimbursement process is used by the respective employee to request a payback of the advanced corporate expense.

With so many moving parts, the ability to maintain transparency and identify when payments are being made and where they are going is key. This is especially true when the number of long-tail transactions increases.

Unfortunately, many businesses lack a solution to manage long-tail spending properly, resulting in ‘payment blindness’ or worse — maverick spending.

In the latest AirPlus B2B payment survey [1], most European purchasing managers indeed see ‘monitoring maverick buying’ as a specific challenge (44%) when processing orders and invoices to or from non-contracted suppliers. In the relationship with non-contracted suppliers, ‘ensuring compliance’ has been selected as the most faced challenge (52%).

The good news? There’s a 5-15% savings potential when making the efforts to optimize long-tail spend management. To illustrate this with figures: a company has a total direct spend of $3 billion of which $400 million is tail spend with a 5-15% savings potential. By not managing its tail spend to capture those savings, the company misses out on $40 million.[2]

The 80/20 Pareto principle explains it: 80% of effects arise from 20% of causes. This means that while long-tail B2B transactions generally are of low value and form only 20% of the volume, they do form on the other hand 80% of the spend complexity.[3]

The way to a smart and simple B2B spend management process

Online B2B purchases are inevitable and will stay in every company’s reality, so much is clear. After all, employees know what goods or services they need for their jobs and seek the smoothest process to get there with as little bureaucracy or interruptions as possible. Also, it pays off for the company’s budget to make an instant purchase online in case of a temporary discount or sale, as the best price of the moment is captured.

So, instead of restricting and fighting this inevitable spending, managing these costs is worth it to save your company admin time and efforts in the long term.

So how to proceed with empowering your employees to make the purchases they need wherever they are while keeping a central grip on long-tail spending and transparency in tracking the costs?

In this digitalizing world, it won’t be a surprise that an automated process is the solution.

Modern procurement platforms can help you out and offer you automation with your existing system landscape. In a big win for business spend management, these innovative platform solutions — like the AirPlus-Mazepay solution— provide a way to link all relevant departments in the long-tail spend process.

Not only can you keep track of all spend from a single screen, but you can also better manage the entire process. This means you can break down those silos, remove the inefficiencies and experience true coordination between your teams at every step.

An example — as offered by AirPlus and Mazepay — is the set-up of an automated approval flow using dynamic request forms for pre-approval on all online purchases without making it troublesome for the employees. Thanks to the controlled process and full audit trail, finance can find all the important information connected to the purchase.

Virtual Cards: enhancing online B2B purchases

The actual payment of the purchase itself connects all further stages in the spend management journey. With your company’s digitalization efforts on that path, the payment method is a crucial element too.

Again, good news: procurement platforms like Mazepay come with an integrated payment service. That means you can also enjoy digitally simplified payments.

The AirPlus Virtual Cards Procurement payment solution is the digital driver by nature to help achieve this goal.

As a 16-digit card number with a three-digit CVC code, specifically generated for individual purchases, the AirPlus Virtual Card is designed for the digital age. It can be used for the entire long-tail, like online, ad hoc, recurring payments and even invoice payments with millions of merchants globally according to the Mastercard® network’s wide acceptance.

With AirPlus Virtual Cards Procurement, you get company-based virtual credit cards that can be individualized for each employee based on their needs. They are ideal for supplier payment, while also providing increased central control using customized security settings you can apply to the cards.

Virtual payments provide end-to-end visibility over decentralized spending. The billing data each virtual card can carry throughout the payment process, enriches your transactions, resulting in a seamless reconciliation of your procurement order and supplier’s invoice or receipt.

AirPlus Virtual Cards Procurement helps you achieve the transparency you need with billing reports for easy cost allocation, for various orders and suppliers you deal with daily.

The below overview illustrates how the stakeholders along the corporate payment process in your company can easily benefit from virtual cards without any impactful system and process changes.

|

Employee |

Purchasing |

Accounting/Finance |

Treasury |

|

Fast payment and delivery of urgently needed services and products |

Simple, secure, and fast central payment and control of ad hoc purchases |

Receipts are always uploaded in time

|

Improved cash flow through extended payment terms |

|

Empowerment as the company has more control over who can generate card numbers |

Discounts due to faster payment are likely |

Easy integration into existing finance and controlling systems |

|

|

No need for (advance) payment with a personal credit card anymore thanks to central virtual card payment |

Integration of card generation on procurement platforms additionally accelerates ordering and payment processes |

Company-specific information facilitates the allocation of expenses via automated reconciliation |

|

|

|

Only approved purchases are paid |

Meaningful reports supporting decision making processes |

|

That’s not all, virtual payment can play an important role in optimizing working capital. In fact, through AirPlus Virtual Cards Procurement, AirPlus as the payment solution provider pays suppliers directly.

Your company receives, at the end of the reporting period, a single detailed account statement and the expenses are then debited by AirPlus to the centralized account of your organization according to the agreed payment terms. This allows you to earn more value days than traditional payments by bank transfer or direct debit.

The joint solution: virtual cards with spend management systems

Considering their strengths as a digital payment option for online buying, virtual card use is growing as a business spend management tool.

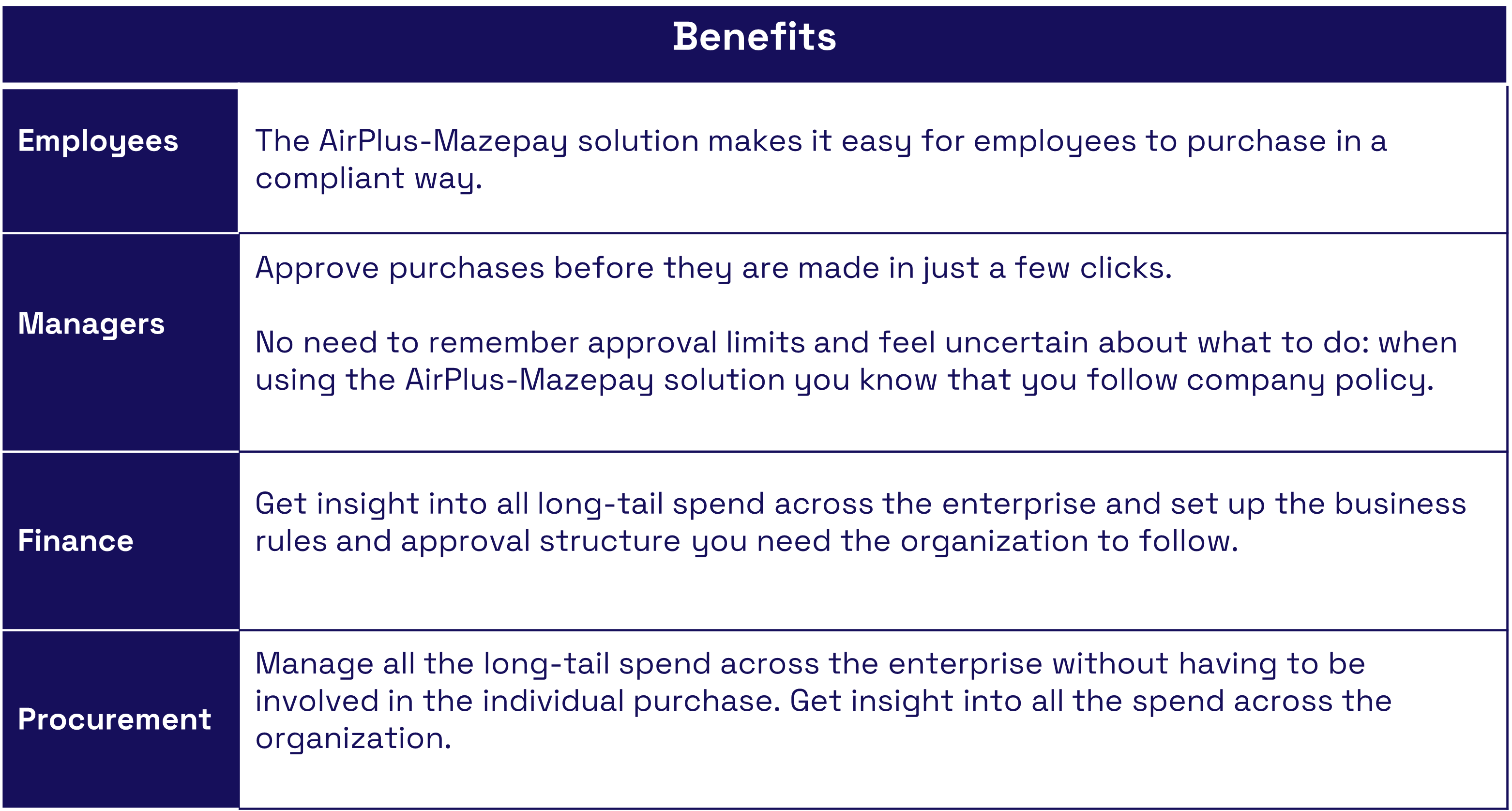

The AirPlus-Mazepay partnership provides bundled benefits for the stakeholders in your corporate payment process:

The virtual cards allow a frictionless and simple payment process for all: as soon as your employee has received approval, a virtual credit card is automatically and seamlessly generated in the background as the means of payment for the compliant purchase order, the transactions can be tracked and reconciled while the supplier receives the payment right on time.

Smart and simple, right? Your suppliers will also be happy with the change.

Conclusion

Between the use of a business spend management platform, virtual cards, and a thorough strategy, it’s possible to see significant improvements both in your company — and out in the case of suppliers. Smaller online payments to one-time suppliers no longer are a headache or drain on resources, while departments such as the treasury team enjoy improved cash flow.

Virtual credit cards offer a flexible and efficient means of payment that is highly compatible with online payment channels. They also work as an integrated payment solution in procurement platforms. This makes monitoring payments much less of a pain. Most importantly, it simplifies your corporate spending

The joint solution offered by the AirPlus-Mazepay partnership provides an easy and secure way of empowering the employees to purchase in a compliant way, paying with the AirPlus Virtual Cards while ensuring that all approvals have been completed according to your company’s policy.

This fully cloud-based solution of virtual cards with an end-to-end process helps you get in control of your entire long-tail spend, minimizing the risks by ensuring compliance and maximizing productivity by reducing cost and efforts for your organization.

Want to know more about what this partnership solution has to offer to make your long-tail spend management worthwhile? The joint solution of AirPlus and Mazepay offers the perfect way for businesses to simplify their indirect procurement processes.

Find out how your business can benefit from our effective long-tail spend management solution.

[1] AirPlus B2B payment survey among 534 purchasing managers from Austria, Belgium, France, Germany, Italy, Luxemburg, Netherlands, Switzerland, and the UK

[2] Long tail, big savings: Digital unlocks hidden value in procurement | McKinsey

[3] Taming Tail Spend | bcg.com